Ethereum Q1'23: State of the Network

The 10Q for Ethereum

“Ethereum’s metrics continue to deteriorate, yet profitability increased 20x quarter-on-quarter. L2s are driving growth across the Ethereum ecosystem.”

If Ethereum had a quarterly earnings release, that would be the leading quote. This article serves as Ethereum’s unofficial Q1’23 results. It captures, comments and dissects:

Ethereum’s operating metrics

The rise of L2s

Ethereum’s income statement

So what to make of the numbers?

Brought to you by artemis.xyz

I used Artemis for all my data needs for this article. With easy formulas it allows me to quickly pull on chain data into Excel and Google Sheets. It saves me hours. Give it a try!

Operating Metrics: Q1’23

Operating metrics commentary

Daily active users: Declined 10% year-on-year (“yoy”), a continuation of Q4’22 trend. DAUs saw an uptick in Q3’22. The merge in September caused an increase in activity. Sequentially the deceleration is slowing. Q1’23 declined 3% quarter-on-quarter (“qoq”). In the first few days of April the average DAUs are up 6% compared to Q1’23. A decline in DAUs means there are fewer people using ethereum on a daily basis.

Average daily transactions: Declined 10% yoy. The deceleration has slowed compared to Q4’22 decline of 16%. Sequentially average daily transactions are nearly stabilizing at -1% qoq. The decline in average daily transactions is due to fewer daily active users. The average transactions / daily active users remains constant around 3 transactions per day.

Eth staked: 15% of eth supply is staked. The amount of eth staked increased 66% yoy and accelerated to 18% qoq. The sequential acceleration is due to the upcoming Shapella upgrade.

Prices: Eth is +55% year to date and +17% since the banking crisis started by Silicon Valley Bank’s implosion.

TVL: in eth declined 35% yoy. The decline should slow in H2’23 as the peak figures are lapped. Sequentially TVL decline deteriorated to -14% from -7% qoq in Q4’22. TVL in $ has increased due to rising $ eth price.

The rise of the L2s

Ethereum Q4'22: State of the Network explained the decline in metrics was due to competition, waning blockchain interest and the rise in L2s. L2s continue to be the dominant theme in the Ethereum ecosystem.

Polygon is the early L2 leader. Technically, Polygon is not a true L2. Polygon’s PoS chain is an Ethereum sidechain. It posts the state of its network to Ethereum. True L2s, like Arbitrum and Optimism, bundle every transaction into a proof that’s posted to Ethereum. The latter are far more secure. They leverage Ethereum’s security and decentralized network.

On March 27, 2023, Polygon took a major step toward becoming a true L2. It launched its zkEVM Mainnet Beta.

The Polygon figures presented herein are for Polygon’s PoS chain. That’s currently where all the users and transactions are. I believe the usage of Polygon’s PoS chain will migrate to its zkEVM in time. Including Polygon’s figures as part of the overall Ethereum ecosystem, gives Polygon the benefit of the doubt that they will become a true L2. It is planning on becoming a true Layer 2. If Polygon were to leave the Ethereum ecosystem, and other L2s couldn’t replace it, the Ethereum ecosystem would be set back considerably.

Ethereum DAUs are stagnant. Growth comes from L2 scaling solutions, namely Polygon (MATIC) and Optimism, as illustrated in the chart below.

Ethereum daily transactions are roughly stagnate as well. Whereas transactions across the entire L2 ecosystem have skyrocketed, mostly on the back of Polygon.

Transactions are occurring on L2s that otherwise would have been executed on Ethereum or would not have happened at all. L2s offer lower transaction costs, higher throughput and faster execution.

The table below illustrates the total average daily Ethereum transactions, the total L2 transactions (comprised of Optimism, Arbitrum and Starknet), and total L2s including Polygon (which adds Polygon to the said L2 subset).

For every 1 million Ethereum transactions, there’s about 2 million Total L2 transactions and 5 million Total L2s including Polygon (Matic). There is a multiplier effect of ~2x for Total L2s and ~5x for Total L2s including Polygon (Matic). The table below indicates that the multiplier is growing. That’s a good thing. It proves Ethereum is scaling. For the same number of transactions on Ethereum, there are now 2-5x more transactions across the Ethereum ecosystem. The more the multiplier grows, the more Ethereum is scaling.

The tables below depict total Ethereum and L2 average daily transactions per quarter. A clear trend emerges that the total number of transactions is growing yoy and qoq. The first table below shows the average daily transactions figures excluding Polygon and the second including Polygon.

The entire Ethereum ecosystem (including Polygon, Optimism, Arbitrum and StarkNet) executes 6 million transactions per day (3 million excluding Polygon). It has roughly a 30% share (15% share excluding Polygon) of total blockchain transactions as illustrated in the chart below. Solana is excluded from the table. Its transaction figures are not directly comparable to other chains. Solana executes nearly 30 million transactions per day. It is arguably one of the most performant blockchains. However, since its transaction throughput is so high and fees low, a large portion of its transactions are spam.

Ethereum income statement

Total fees: Declined 66% yoy driven by a 62% reduction in transaction fees and 10% lower transaction volumes. Revenue grew 43% sequentially. The sequential growth was driven by fees being up 44%, while transaction volumes declining 1%.

Gross profit: A gross profit margin of 83% in the quarter means that 83% of total fees generated were burned.

Net income: Net income increased 20x sequentially. The staggering growth in net income is due to a 40% qoq growth in total fees and an increase in gross margin. The sequential growth in net income exemplifies Ethereum’s operating leverage. Ethereum has been profitable for the two quarters since PoS was introduced. The dramatic profit improvement is driven by a 90% decline in the cost of issuing tokens.

Tokens outstanding: Ethereum burned more tokens than it issued in Q1’23. Tokens outstanding declined from 120.53 million to 120.45 million. Net token issuance (calculated as annualized net tokens issued divided by beginning balance) has declined from low single digit percentage to slightly negative.

How to interpret Ethereum’s income statement?

Total fees comprise of the base fee and tip. The tip is a pass through expense. It is paid out to validators. Note the tip fee line item is the same number as the fee paid to validator expense line item. It is a variable cost. It grows in proportion to usage. Users pay a tip fee to have their transactions prioritized.

The base fee is paid by users to process transactions. Note the base fee number is the same as the gross profit figure. Gross profit indicates how much money (denominated in eth) the Ethereum blockchain makes for the transactions it processed. It is sometimes referred to as network revenue. The gross profit margin represents how much of total Ethereum fees are burned. Burned tokens are removed from circulation. It’s similar to a share buyback.

Cost of issuing tokens is the expense paid to validators to keep the network secure. It's a fixed cost. It does not increase proportionally to usage. PoS reduced new token issuance by 90%.

Net income is the difference between gross profit (ie base fee) and new token issuance. Ethereum’s net income of 79,210 in Q1’23 means it collected 79,210 more in base fees than it issued in new tokens. As a result, Ethereum’s tokens outstanding was reduced by 79,210.

The more net income Ethereum generates, the more eth is burned, the fewer tokens there are outstanding. The fewer tokens are outstanding, all else being equal, the more valuable each token is.

So what?

1. It’s all about L2s

Ethereum metrics in isolation are becoming less indicative of the health of the overall Ethereum ecosystem. Ethereum usage and transaction metrics continue to decline. But the usage and transaction figures of L2s are booming. L2s drive overall network usage, which in turn increases Ethereum usage and ultimately increases Ethereum’s revenue. Revenue growth drives token burn.

L2s are the leading indicator of the value created in the Ethereum ecosystem and the potential value accruing to Eth token holders.

2. Eth staked is about to increase

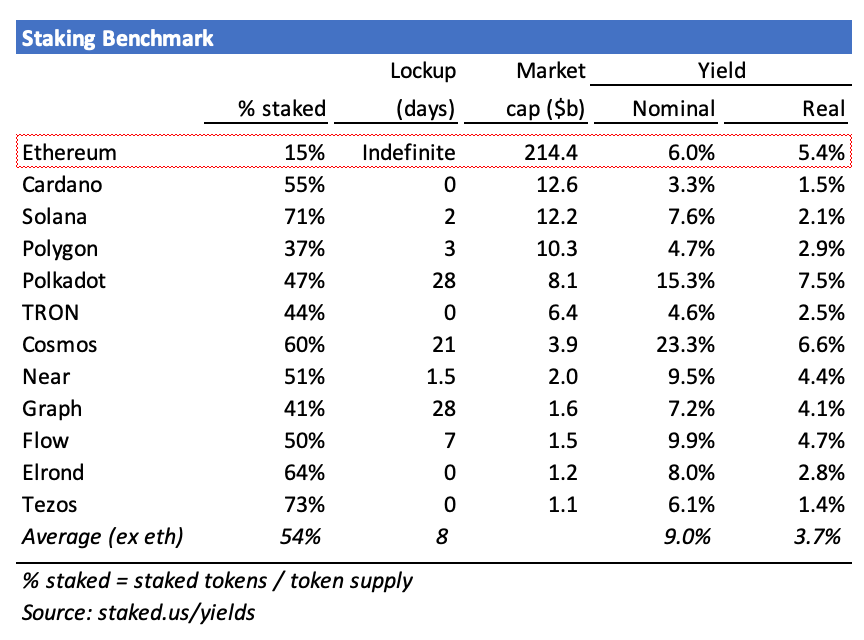

The amount of eth staked is 15% of total tokens outstanding. The average across other large PoS chains is 54% (see table below). There are two structural reasons why eth staked is lower than rival PoS chains. First, Ethereum converted to a PoS chain a mere 7 months ago. Second, unlike other PoS chains, Ethereum stakers are unable to unstake their tokens. Staking eth means locking it up indefinitely. That’s about to change.

The Shapella Ethereum upgrade is going live on Mainnet April 12. Included in the upgrade is the ability of stakers to unstake. No longer will staking eth mean tying up capital indefinitely. Subsequent to the upgrade there is no reason why not to stake eth.

There is a common misconception that permitting validators who staked their eth to unstake will cause an eth selloff post Shappella upgrade. It won’t.

Full validator exits are rate limited by the protocol. Only six validators may exit per epoch. Epoch lasts 6.4 minutes, which implies 1,350 exits per day are possible. 32 eth are staked per validator. If all 1,350 exit slots are used, then 43,200 eth (1,350 x 32 eth) per day can be unstaked. 18 million eth is staked. It would take 417 days for 18 million eth to be unstaked (18 million / 43,200). Furthermore, the eth staking yield is inversely correlated to the amount staked. As more eth is unstaked, the staking yield increases, which incentivizes more people to stake.

3. Sell pressure has shifted to buy demand

Ethereum’s profitability and burn mechanism is a big deal. Ethereum has shifted from $20 million per day of sell pressure, at a $1,900 eth price, to $5 million per day of buy demand; a $25 million delta.

Economically there were two problems with Ethereum’s PoW model. First, Ethereum used to issue 15,000 tokens a day to miners. That’s nearly 5% annual dilution. Second, an estimated 70% of those tokens were sold to fund costly mining operations. At a $1,900 eth price, the token issuance to miners and subsequent selling led to $20 million of daily sell pressure.

The combination of switch to PoS and the introduction of the burn mechanism, converted the $20 million a day sell pressure to a $5 million daily buy pressure. You can think of Ethereum burning (ie buying back) $20 million worth of tokens every day, whereas it used to sell $20 million of eth tokens daily. The table below outlines the pro forma income statement from PoW to PS.

The forecast column in the table above calculates what Ethereum’s income statement would look like if fess increased 5x. In tradfi speak, Ethereum has high gross margins and benefits from operating leverage. When revenues increase 5x, net income increases 9.7x. A 5x fee revenue increase creates a 3.8% token deflation and a $26 million average daily buy demand.

4. Ethereum is the (only) profitable blockchain

Ethereum became the first profitable blockchain. Excluding Binance Smart Chain, none other is close. That’s a huge deal for 3 reasons:

i) Ensures sustainability

Validators are paid to process transactions and secure blockchains. Security is tantamount to existence for blockchains. Validators are paid in new token issuance. If validators are paid in tokens that keep going down in value, they will stop validating. They will no longer have an economic incentive to validate. The security of the blockchain will be compromised. Users will stop using it. The whole thing will quickly unravel.

A token's value could fall precipitously if there is a flood of new tokens being issued. Ethereum’s new economic model prevents a flood of new token issuance. The economic incentive for validators to continue validating is preserved. As a result, Ethereum’s security and ultimately its sustainability as a blockchain is ensured.

Profits are necessary for the long term viability of a blockchain.

ii) Attracts outsiders

Ethereum has a powerful economic engine. Ethereum’s costs do not grow commensurately with its revenue. Ethereum will become incredibly profitable as revenues grow. Profits equate to more eth burn, which reduces the number of eth tokens outstanding. Ethereum’s attractive economics will bring additional capital, interest, developers and users.

I think the profitability potential of Ethereum is lost on most people. Those in crypto are more familiar with Ethereum’s technology than its economics. Those outside of crypto are staying clear of anything crypto related.

iii) Compounds Ethereum’s network effect

The more profitable Ethereum is. The more secure it is. The more attractive it is to invest in; whether that’s developers building, users using or investors deploying capital. Profitability makes Ethereum’s network effects stronger.

Stay curious.

Like this article? Hit the “♡ Like” button.

Likes are actually a big deal. They serve as a proxy for new visitors and feed into Substack’s algorithm that distributes my articles to all Substack readers. If you enjoy this article, don’t be shy :)'