Ethereum Q4'22: State of the Network

The first ever profitable blockchain

“Ethereum’s key metrics continue to decelerate while it became the first ever profitable blockchain.”

If Ethereum had a quarterly earnings release, that would be the headline. This post serves as Ethereum’s Q4 results. It captures:

Key performance metrics

What is causing the decline

Income statement

So what

Key Performance Metrics

Q4’22 Results

Operating metrics commentary

Unique addresses: Grew 19% year-on-year (“yoy”). The lower growth trajectory is consistent to the prior two quarters. It’s down from 40-60% growth in 2021. The deceleration indicates that the number of new people coming to Ethereum is slowing.

Daily active addresses: Declined 21% yoy. There has been an uptick in the beginning of January. But the trend is still down. There are fewer people interacting daily with Ethereum.

Average daily transactions: Declined 16% yoy. Ethereum has continuously been used less frequently in 2022 compared in 2021.

Eth staked: Continued to grow +74% yoy, but growth has slowed sequentially.

Market and DeFi metrics commentary

Prices: Another bumpy ride for Eth. Surprisingly, notwithstanding FTX collapse, Eth did not hit new lows.

TVL (eth): Declined 25% yoy and 18% sequentially. The interest in DeFi throughout the year has waned due to market implosions.

2022 Results

On an annual basis, it’s clear to see Ethereum had enormous growth in its key metrics in 2020 and 2021. In 2022, it gave back many of its gains.

What happened?

Ethereum growth has decelerated for three reasons:

1. Competition

Alternative Layer 1 blockchains emerged in 2021 and proliferated in 2022. Ethereum is no longer the only game in town. Ethereum’s share of Daily Active Users (“DAU”) was nearly 100% at the end of 2020 and declined to 15% today.

Competition emerged to address Ethereum’s shortcomings: transaction speed and costs. Ethereum struggled to scale (read Ethereum can’t scale…or can it?).

2. Waning blockchain usage

DAUs peaked in November 2021 at 2.6 million, along with crypto market cap at $2.8 trillion. DAUs declined to 2.1m today, a 20% decline. While crypto market cap declined to $0.9 trillion, a 70% decline. Blockchain usage has declined, but not nearly as much as prices.

3. Layer 2 scaling solutions

Layer 2 scaling solutions emerged to compete with alternative layer 1 blockchains. Ethereum scaling solutions include Polygon, Arbitrum, Optimism and StarkNet. They offer 30-50 transactions per second, compared to Ethereum around 12. Transactions costs on Layer 2s range from a few cents to fractions of a cent, compared to Ethereum near $2. Ethereum and Layer 2s are rolling out innovations that should enable them to scale to tens of thousands of transactions per second at fractions of a penny.

Simplistically, Layer 2s batch a whole bunch of transactions together and input them as one transaction on the Ethereum blockchain. Layer 2s leverage Ethereum’s security. Combined, Ethereum and Layer 2s massively scale transaction throughput without compromising security and decentralization. For a more detailed explanation of how Layer 2s work read Ethereum can’t scale…or can it?

Scaling solutions launched in summer of 2021. Polygon has been enormously successful. It has partnered with Disney, Starbucks, Reddit and Meta among others. The number of active addresses on Polygon has rivaled that of Ethereum. Polygon is processing 3 times more transactions per day than Ethereum.

Layer 2 activity benefits the Ethereum ecosystem. They are transactions that would have otherwise happened on Ethereum or competing blockchains. Since Layer 2 transactions are ultimately settled on Ethereum, eth is consumed. Part of the deceleration in usage metrics of Ethereum is because transactions have moved to Layer 2s.

Technically speaking, Polygon is not a true Layer 2. Polygon is an Ethereum sidechain that posts the state of its network to Ethereum. True Layer 2s, like Arbitrum and Optimism, bundle every transaction into a proof that’s posted to Ethereum. The latter are far more secure. They leverage Ethereum’s security and decentralized network.

Polygon’s current architecture is a workaround to scale. It is planning on becoming a true Layer 2. If Polygon were to leave the Ethereum ecosystem, and Layer 2s couldn’t replace it, the Ethereum ecosystem would be set back considerably.

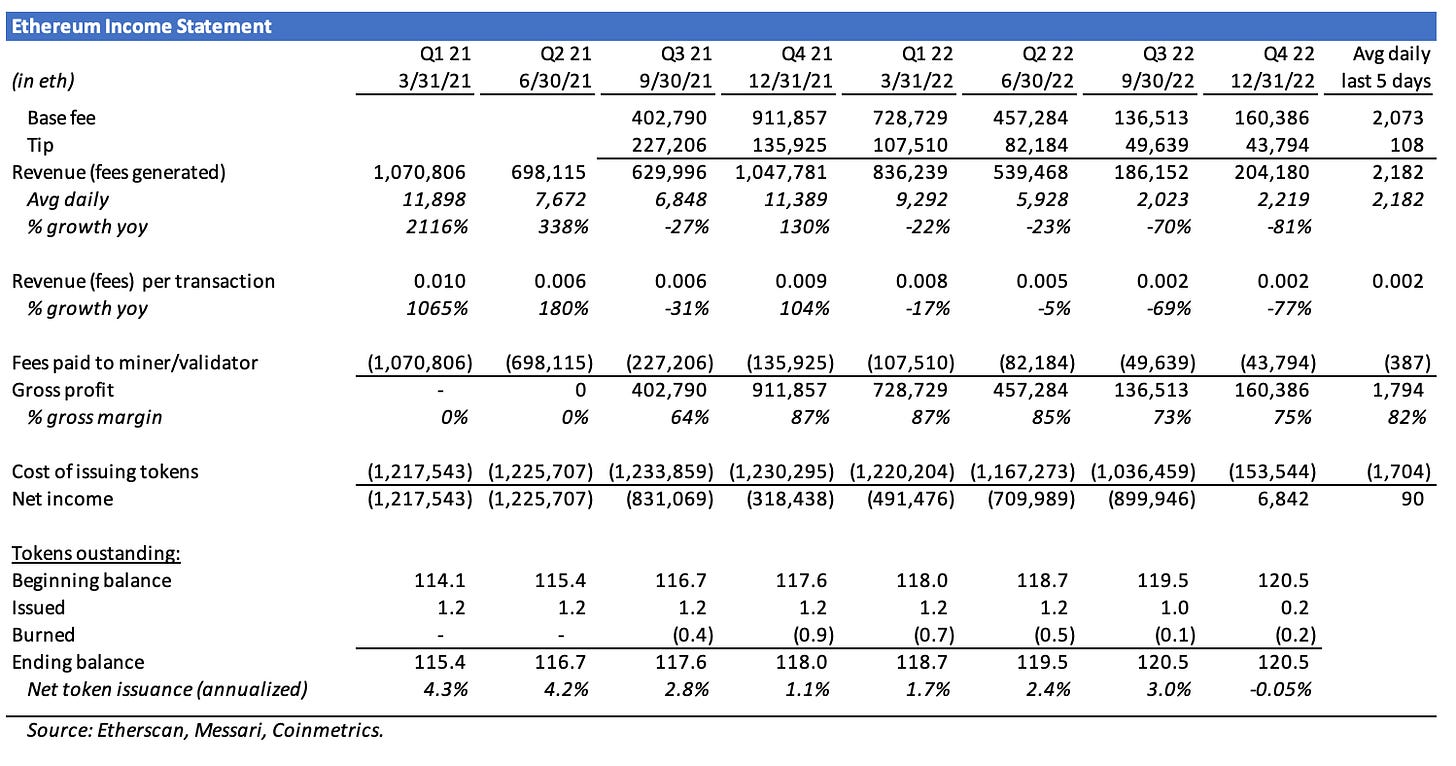

Ethereum income statement

Revenue: Declined 81% yoy driven by a 77% reduction in transaction fees and 16% lower transaction volumes. Revenue grew 10% sequentially. The sequential growth was driven by fees being up 20%, while transaction volumes declining 8%.

Net income: Ethereum was profitable for the first time in history! PoS was introduced September 15. Since then, Ethereum has oscillated between slightly loss making to profitable. The dramatic profit improvement is driven by an 85% decline in the cost of issuing tokens.

Tokens outstanding: Ethereum burned slightly more tokens than it issued in Q4’22. Tokens outstanding declined from 120.53 million to 120.52 million. Net token issuance (calculated as annualized net tokens issued divided by beginning balance) has declined from low single digit percentage to slightly negative.

How to interpret Ethereum’s income statement?

Revenues comprise of the base fee and tip. The tip is a pass through expense. It is paid out to validators. Note the tip revenue line item is the same number as the fee paid to miner/validator expense line item. It is a variable cost. It grows in proportion to usage. Users pay a tip fee to have their transactions prioritized.

The base fee is paid by users to process transactions. Note the base fee revenue number is the same as the gross profit figure. Gross profit indicates how much money (denominated in eth) the Ethereum blockchain makes for the transactions it processed. The base fee is burned, meaning those tokens are removed from circulation. It’s similar to a share buyback.

Cost of issuing tokens is the expense paid to validators to keep the network secure. It's a fixed cost. It does not increase proportionally to usage. PoS reduced new token issuance by 85%.

Net income is the difference between gross profit (ie base fee) and new token issuance. Ethereum’s net income of 6,842 in Q4’22 means it collected 6,842 more in base fees than it issued in new tokens. As a result, Ethereum’s tokens outstanding was reduced by 6,842. The reduction in eth outstanding is captured in the negative net token issuance metric.

The more net income Ethereum generates, the more eth is burned, the fewer tokens there are outstanding. The fewer tokens are outstanding, all else being equal, the more valuable each token is.

2022 Income statement

On an annual basis, Ethereum revenues declined 49% yoy. Revenue decline was mostly driven by a 42% drop in transaction fees. The revenue decline is off the back of two big growth years. Gross profit improved in 2022 because of the full year of the burn mechanism, which was implemented in August 2021.

So what?

Here are the key things to takeaway and why they’re important.

1. Ethereum metrics are hurting

There is no denying usage metrics are decelerating. Usage is more important than revenue. Usage needs to rebound for Ethereum to live up to its potential. The improvement lies in continuing to increase transactions per second and lowering costs.

2. The reason for the hurt ain’t all bad

First, widespread use of blockchains is down. But it’s only down 20% while market prices are down 70%. That actually bodes well for the technology. People are still into the technology regardless of price declines.

Second, competition is real. Ethereum has lost massive share. That was bound to happen when you’re 100% of the market. The allure of alternative layers 1s have lost some of its luster. The appeal of Ethereum is growing. Ethereum’s roadmap to scale to tens of thousands of transactions per second is real. We’re probably in a multi-chain world. Different chains cater to different needs. All chains likely serve to grow the overall market and foster innovation. Competition at this stage ain’t a bad thing.

Third, Layer 2s (for sake of simplicity I’m including Polygon) could serve as a springboard. Ethereum usage metrics including Layer 2s indicate that usage continues to grow at a rapid pace. The true connection between Polygon and Ethereum is nebulous. Polygon could prove to be a watershed for Ethereum. If it doesn’t, other scaling technologies are waiting in the wings. Usage may not actually be down, it may actually be growing and it's poised to be catapulted.

3. Profits like whoa!

Ethereum became the first profitable blockchain. Excluding Binance Smart Chain, none other is close. That’s a huge deal for 3 reasons:

A) Ensures sustainability

Validators are paid to process transactions and secure blockchains. Security is tantamount to existence for blockchains. Validators are paid in new token issuance. If validators are paid in tokens that keep going down in value, they will stop validating. They will no longer have an economic incentive to validate. The security of the blockchain will be compromised. Users will stop using it. The whole thing will quickly unravel.

A token's value could fall precipitously if there is a flood of new tokens being issued. Ethereum’s new economic model prevents a flood of new token issuance. The economic incentive for validators to continue validating is preserved. As a result, Ethereum’s security and ultimately its sustainability as a blockchain is ensured.

Profits are necessary for the long term viability of a blockchain.

B) Attracts outsiders

Ethereum has a powerful economic engine. Ethereum’s costs do not grow commensurately with its revenue. Ethereum will become incredibly profitable as revenues grow. Profits equate to more eth burn, which reduces the number of eth tokens outstanding. Ethereum’s attractive economics will bring additional capital, interest, developers and users.

I think the profitability potential of Ethereum is lost on most people. Those in crypto are more familiar with Ethereum’s technology than its economics. Those outside of crypto are staying clear of anything crypto related.

C) Compounds Ethereum’s network effect

The more profitable Ethereum is. The more secure it is. The more attractive it is to invest in; whether that’s developers building, users using or investors deploying capital. Profitability makes Ethereum’s network effects stronger.

Stay curious.

Follow me on Twitter for my latest @samuelmandrew

Thank you to @vivekventures.eth for his edits.

Definitions

Operating metrics

Unique addresses: the total distinct numbers of addresses on the Ethereum blockchain.

Daily active eth addresses: the daily number of unique addresses that were active on the network as a sender or receiver.

Eth staked: the number of eth tokens staked on the Beacon Chain.

Transaction volume USD: the sum USD value of all native units transferred.

Transaction volume ETH: the sum of eth tokens transferred between distinct addresses.

TVL $: the USD sum value of all eth locked in DeFi.

TVL ETH: the sum of value of all eth locked in DeFi.

Income statement

Base fee: the portion of gas fee that is paid to Ethereum and burned. Introduced by EIP-1559. Implemented August 2021.

Tip: the portion of the gas fee that is paid to validators (previously miners). Introduced by EIP-1559. Implemented August 2021.

Fees paid to miners/validators: The fee paid to validators (previously miners) to process transactions. Prior to EIP-1559 implementation, all fees were paid to miners. Subsequent to EIP-1559, only the tip is paid to validators.

Gross profit: Total revenues less fees paid to miners/validators. Post EIP-1559, gross profit equals the base fee. The base fee is burned, which reduces the number of eth tokens outstanding.

Cost of issuing tokens: are the eth tokens issued to validators (previously miners). Prior to the merge, validators received 2 eth tokens for each block contributed. Subsequent to the merge, validators receive block rewards based on the total number of eth tokens staked.

Love it!