The Dankest EIP

EIP 4844: what it is and what's misunderstood

The goal of Ethereum’s roadmap is to scale to hundreds, thousands and ultimately one-hundred thousand transactions per second with transaction fees that don’t limit usage. The first scaling step in Ethereum’s rollup centric roadmap is the implementation of EIP-4844. 4844 should be implemented in Q4 2023. It will lower the cost of posting L2 transaction data to Ethereum by 90%. It will increase the amount of L2 data that can be stored on a block by 10x. 4844 could have a negative near-term impact on Ethereum fees and burn. It could also massively increase the profitability of L2s. The market is misunderstanding the impact of 4844.

This article details:

The problem 4844 is addressing

What is EIP-4844

Why 4844 is a big deal

What’s misunderstood

What’s so dank

Why now

4844 addresses two problems

L2s encounter two problems with Ethereum’s existing architecture:

Data storage: L2s create a lot of data. They process a million transactions per day. They’ll process even more. Transaction proofs are rolled up and posted to Ethereum. L2s encounter bottlenecks posting all that data.

Transaction costs: Posting transaction data from L2s to Ethereum is more expensive than desired. Scaling L2s requires lower transaction costs.

4844 addresses these two problems. It introduces a way to include more data in Ethereum blocks. It lowers the cost of posting L2 data to Ethereum, which should reduce L2 transaction fees for users.

What is EIP-4844?

4844 introduces two new dynamics to Ethereum. Data blobs increase data throughput for L2 transactions. Data gas is a reduced transaction fee for L2 transactions. The result is higher data throughput and lower cost to post L2 data to Ethereum.

Data blobs

4844 introduces ‘blob-carrying transactions.’ The differentiating factor of blob-transactions is that they embed additional data, referred to as a blob. Blob is short for Binary Large Object. A blob is a collection of data stored as a single entity. It is like a compressed zip file.

Blobs provide a massive increase in data storage. A blob is 125,000 bytes. An Ethereum block can have 8 blobs for a total of 1,000,000 bytes. For context, the average Ethereum block size is 110,000 bytes (the theoretical maximum Ethereum block size is 1,800,000 bytes). Data blobs create nearly a 10x increase in data stored compared to Ethereum’s average block size.

Blobs append more data to Ethereum blocks. They enable more data to be processed through a block without increasing the block size. Ethereum’s blocks are purposely size constrained. Increasing block sizes would increase centralization. Larger blocks require more computing power to process. The greater the infrastructure requirement to participate in the network, the fewer the participants, the less decentralized.

Blobs are stored by the Ethereum’s consensus layer. Blob-transactions do not add requirements to validators because blob data is automatically deleted. 4844 suggests that blobs should be deleted after 30 to 60 days.

Deleting blob data is not catastrophic. It’s necessary for Ethereum to scale. Ethereum’s purpose is not to store all data indefinitely.

“The purpose of the Ethereum consensus protocol is not to guarantee storage of all historical data forever. Rather, the purpose is to provide a highly secure real-time bulletin board, and leave room for other decentralized protocols to do longer-term storage.” - Vitalik

The blob data needs to be available long enough for any user who wants it to be able to access it. Users may check the validity of the underlying data. Protocols and applications may integrate it into their projects. A month or two appears sufficient.

Ethereum’s entire history will be stored across several actors. Rollups can require their nodes to store a portion of data history that is relevant to them. Block explorers and API providers store history. Academics may choose to store historical data. Third party storage applications store the entire history. Long term historical data storage only requires one of the data storers to be honest. Hence, it can be stored in disparate places by different actors. The entire history does not need to be stored by all nodes. Disparate historical data storage needs to occur. The entirety of Ethereum history is too unwieldy to require node operators to download all of it.

Data gas

Data gas is a new fee type exclusively for blob-transactions. Data gas decouples the cost of posting L2 data to Ethereum from Ethereum’s gas price. Data gas will have its own dynamic price based on blob demand and supply. The outcome is a lower cost for L2s to post their data to Ethereum.

The issue with the current design is that the entire L2 transaction incurs costly gas fees. 4844 rectifies this problem by splitting the fee of a blob-transaction into a normal gas component and a data gas component. De minimis normal gas is incurred for the EVM operation of the blob-transaction. Data gas is incurred for the data blob component. L2s will no longer pay costly gas for the entirety of the data they post to Ethereum.

One blob with 125,000 bytes will cost 125,000 data gas to include in each block, which implies 1 data gas/byte. A similar transaction under the current design costs 16 gas/byte. Data gas is 16x (90%) cheaper.

Why 4844 is a big deal

Implementing EIP-4844 is a big deal for three reasons:

1. Scaling: 10x increase in L2 data throughput

Implementing 4844 is the first EIP in Ethereum’s rollup centric roadmap that introduces tangible scaling and cost benefits. Upgrades prior to 4844 laid the foundation for scaling. 4844 is the beginning of a new chapter in Ethereum’s history. A chapter focused on tangible scaling initiatives.

Data blobs enable a 10x increase in the amount of L2 data that can be appended to an average Ethereum block. No other recent EIP offered that magnitude of scaling.

2. Cost reduction: 90% reduction in posting L2 transaction cost to Ethereum

The cost to post L2 transactions to Ethereum will decline by 90%.

3. The potential impact of 4844 is misunderstood

4844 could be near term bearish for Ethereum. The impact of 4844 on L2 transaction fees for users is unclear.

What’s misunderstood

1. Is 4844 near term bearish for ETH?

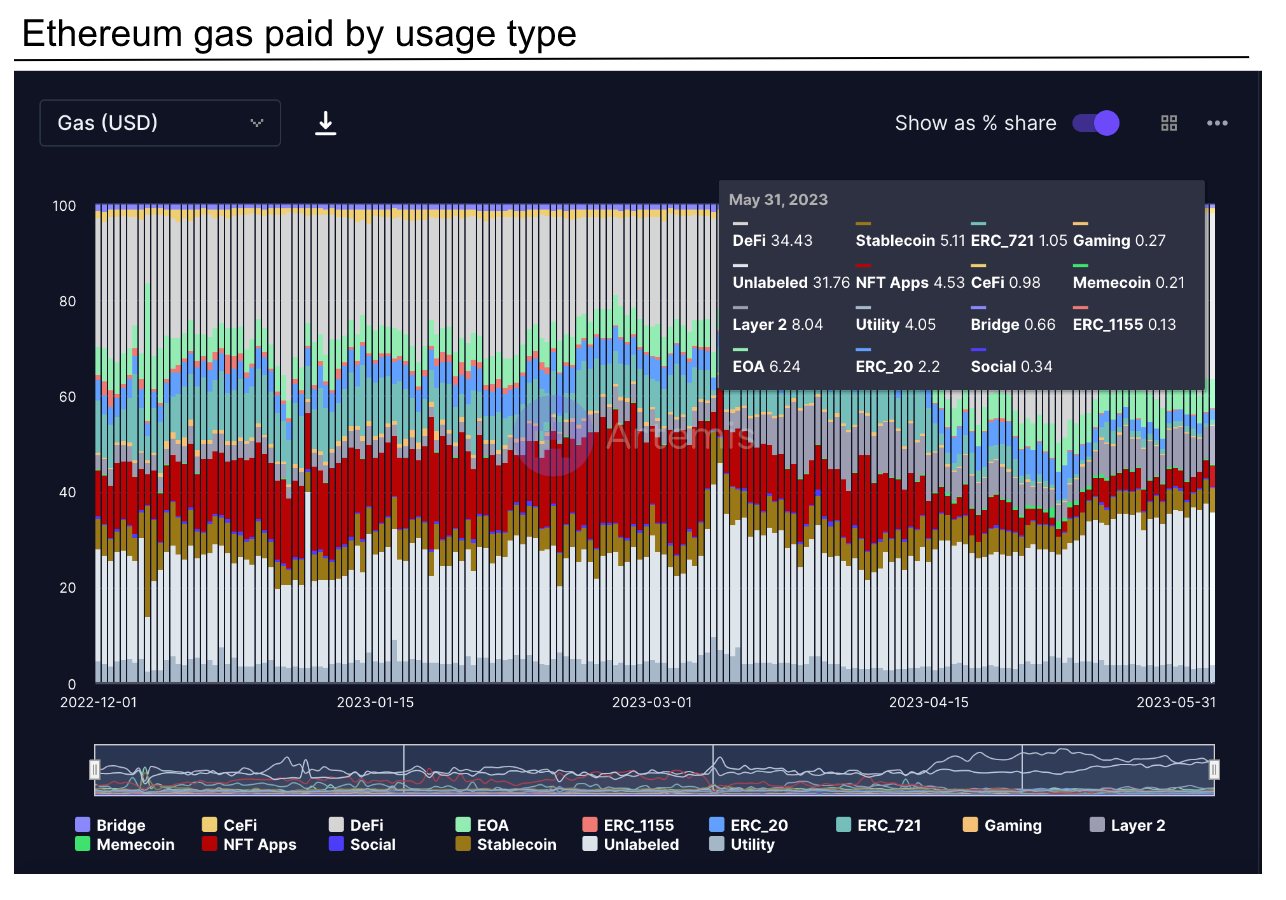

4844 reduces the fees L2s pay to post their transaction data to Ethereum by 90%. 8% of total Ethereum gas fees are paid by L2s (see chart below). It’s not a material amount, but it’s growing rapidly. Six months ago L2s comprised 3% of total Ethereum gas. L2s contributed 70% of the year on year growth in gas from February to April this year. When nearly everything is showing declining metrics, L2 transactions, and as a result gas paid by L2s, is growing.

4844 could be near term bearish for Ethereum. L2s are the preferred scaling solution. The number of L2 transactions will continue to grow. However, the price paid to post those transactions to Ethereum is about to drop by 90%.

Total Ethereum fees could decline 9% as soon as 4844 is implemented. A decline in fees would reduce ETH burn. If L2s comprise 10% of total gas by the time 4844 is implemented and face a 90% fee reduction then total Ethereum gas fees will decline by 9%.

Ethereum generates $10 million in daily fees. Ethereum transaction fees have oscillated between $3 and $27 this year and are now $8. Transacting on L2s currently costs $0.10 to $0.40. 4844 could make current L2 transaction fees up to 90% cheaper.

So, do even cheaper L2 fees cannibalize existing Ethereum revenue?

Traders and projects currently transacting on Ethereum paying ETH gas could switch to L2s. L2 fees are already 95% cheaper than Ethereum. I’m not sure making L2s another 90% cheaper moves that much existing Ethereum activity onto L2s. Traders and projects had plenty of opportunity in the last two years to leave Ethereum for cheaper fees on rival blockchains. I suspect that the activity that was price sensitive has mostly left Ethereum already to cheaper alternatives, including L2s.

We may see some cannibalization, but I suspect the potentially cheaper L2 fees for L2 users will create more incremental demand than cannibalization. Increasingly cheaper transaction fees facilitate use cases that couldn’t previously exist. But there could be a timing mismatch. Near term there could be some cannibalization before incremental volumes emerge from new use cases.

I don’t think the market understands that 4844 presents a near term headwind for Ethereum.

4844 is constructive in the medium to long term. L2s should benefit from increased transaction volumes if they pass on the 4844 cost saving to L2 users. In theory, what Ethereum loses out in lower gas fees paid by L2s and existing revenue cannibalization, is made up by higher volumes. But there will be a rocky interim. The cost to post L2 data will drop 90% overnight once 4844 is implemented, but the offsetting increase in volumes will be gradual.

2. What will happen to L2 user fees?

L2’s operating cost is the gas paid to post transaction data to Ethereum. The difference between the transaction fee charged to L2 users and the cost of posting transaction data to Ethereum is the L2s profit. The L2s operating cost will decline by approximately 90% subsequent to 4844 going live. The profitability of L2s stands to increase dramatically.

But will it?

If L2s keep the cost savings for themselves, then yes, their profitability will increase dramatically. The benefit of which will accrue to L2 treasury and potentially token holders.

But it’s not that simple.

The purpose of EIP-4844 is not to create a massive windfall for L2s. But that may be an unintended temporary consequence.

L2s will ultimately have to pass the cost savings from 4844 on to L2 users. L2s are commodities. They sell cheap blockspace. Users prefer the cheapest L2. L2s are in the business of growing volumes, not price. A prisoner's dilemma emerges between L2 competitors. L2s are all better off if they collude and keep the cost savings for themselves. But a disproportionate benefit, in the form of additional volumes, accrues to the L2 that defects and passes on the cost saving to L2 users. All L2s pass on the cost saving fearing their competitor will. It’s a race to the bottom. The entire cost saving is eventually passed on to L2 users. But in the interim, L2s will be disproportionately profitable.

I think this dynamic is misunderstood by the market. Most don’t realize this will happen. Some think the value will accrue to L2s indefinitely.

What’s so dank?

4844 is referred to as proto-danksharding. The weirdly fitting name is worth explaining. It’s a combination of names and words: sharding, dank and proto.

Sharding is a common database management function to split up large data sets. Usability of databases deteriorates with more users and data. Databases are sharded to improve performance. The data is split up into small chunks, called “shards,” that are distributed across several machines in parallel. Ethereum is an overloaded database that will be sharded.

Ethereum will pursue danksharding. ‘Dank’ refers to Dankrad Feist, the Ethereum Foundation researcher who pioneered Ethereum’s sharding roadmap (read Ethereum Can’t Scale…or Can It? to understand danksharding.) Danksharding is several years out. Proto-danksharding is a stepping stone toward danksharding. It provides a scaled back version of danksharding benefits without sharding Ethereum. The “proto” prefix is a reference to Protolambda, the Ethereum Foundation researcher who developed proto-danksharding.

Why now in this form?

4844 is being implemented now (well later this year) in its form because:

1. Provides immediate benefit

L2s are live and operational on Ethereum. They’re poised to grow considerably. They require debottlenecking and cost savings to scale. 4844 provides both immediately. Where 4844 falls short on the complete scaling benefits of danksharding, it makes up by being shipped now. Danksharding will take years to implement. Ethereum needs a scaling upgrade before then. 4844 is that scaling upgrade.

The Ethereum community believes it’s better to provide continual upgrades rather than one large sharding upgrade in several years time. I think the community is learning from its experience transitioning to PoS. The merge took a long time to enact. Alternative L1s developed viable rival products in the meantime.

2. Sets the stage for danksharding

4844 (a.k.a proto-danksharding) institutes many of the upgrades required for danksharding. 4844 implements:

A new transaction type (blob-transactions) and gas type (data gas). Both of which will exist in their same capacity in danksharding. The architecture of data blobs are forward compatible with Data Availability Sampling. Data Availability Sampling is a key tenet of danksharding. It reduces the data load on the network.

All the execution-layer logic required for danksharding.

Only the consensus layer and its clients will need to be upgraded for danksharding. The execution layer and its clients will be danksharding compatible once 4844 is implemented. Thereafter the execution layer is unencumbered to pursue any upgrade initiatives.

So what…

EIP-4844 is the first big step in Ethereum’s scaling roadmap. It’s the beginning of Ethereum’s scaling phase. It provides immediate tangible scaling and cost benefits. The ability to post L2 transaction data to Ethereum should increase by 10x. The cost to post said transactions, and ultimately the fees L2 users pay, should decline by 90%. 4844 has some unintended consequences the market is unaware of, namely: a near term headwind for Ethereum fees and burn and a temporary massive step up in L2 profitability.

Stay curious.

A special thank you to @sean_sacha for informing my thinking on EIP 4844.

Don’t forget to hit the “♡ Like” button!

♡ are a big deal. They serve as a proxy for new visitors and feed into Substack’s algorithm that distributes my articles to all Substack readers.

And…why not share this article?

Follow me on Twitter @samuelmandrew for my latest takes.

Thanks for your in-depth views here