The Business Case for Ethereum

Assessing Ethereum from a business standpoint: its revenue, cost, profitability and the game changing impact of the merge.

What is the business case for Ethereum?

It generates revenue and incurs costs, but is it profitable? It’s growing rapidly, but is it sustainable? It creates value, but who benefits from its value creation? And what’s this merge thing?

I spent my professional life assessing businesses. Ethereum had me confused…how does it actually work from a business standpoint? I explain how the business of Ethereum works today and how it’s about to drastically change. A change that’s the biggest thing in crypto since Ethereum launched. I’ll cover:

What is it selling?

How does it generate revenue?

What are the costs?

Ethereum’s Income Statement

What do I actually own?

Does a blockchain need to be profitable?

What’s the merge?

The new cost structure

PoS economics

Post merge Income Statement

What do I own post merge?

Why is the merge a big deal economically?

What does Ethereum sell?

Ethereum sells a single product: blockspace. Blockspace is exactly what it sounds like, it is space on a blockchain.

Why do people want blockspace?

To store information

To run code

Why would I want that?

Storing information on a block is akin to property rights in the digital era. It enshrines ownership. Running code allows the information to interact with one another to generate new outputs.

Why does it need to happen on a blockchain?

The design of a blockchain makes it incredibly difficult for it to be hacked. The information is not controlled or owned by a third party. Blockchain’s programmability allows code to be written to dictate how the information will interact to yield new outputs.

Why am I willing to pay for that?

Security. Ethereum sells more than blockspace, it sells security. Users are confident that the contract will be executed and the block that recorded their assets won’t get hacked.

How does Ethereum generate revenue?

Price x Volume = Revenue

Each time a transaction is posted to the Ethereum blockchain, blockspace is sold to house that transaction, and revenue is generated. Just like a business, blockchain’s revenue is a product of price and volume.

Price, called gas fees, is elastic and changes based on the demand for blockspace and the supply of validators to authenticate the transactions. Lots of demand and few validators, gas fees are high. The volume, the amount of blockspace sold, is driven by the number of transactions, which in turn is driven by adoption of Ethereum.

Gas fee x number of transactions = revenue

What are the costs?

The cost of operating a blockchain are:

Ensuring its security

Processing inputs

To perform both, Ethereum uses Proof of Work (PoW) consensus mechanism. PoW allows network participants to agree on the state of all information recorded on the blockchain and prevents bad actors from undermining the integrity of the information recorded. Miners, which are people running advanced computers, validate the integrity of the information recorded by solving cryptographic puzzles.

Miners are rewarded for their work by:

Gas fees: Miners receive 100% of the gas fees paid by the person requesting to have a transaction processed on the Ethereum blockchain.

Token issuance: Miners get 2 newly minted eth for each validated block contributed to the blockchain. Blocks are batches of transactions that link to the prior block creating a chain, hence the name blockchain.

Ethereum Income Statement

The Ethereum blockchain is not profitable. Revenues are the sum of gas fees and, until EIP 1559 was implemented, miners received all of the gas fees. Ethereum Improvement Proposal 1559 split the gas fees between the tip, which is paid to the miners, and the base fee, which is kept by the protocol and “burned.” The eth burned is taken out of circulation reducing the number of eth tokens outstanding. The gross profit shown on the income statement is the base fee kept by the protocol. The base fee (ie gross profit) is then used to reduce (ie burn) the number of tokens outstanding.

Network metrics

Transaction volumes represent the total USD value of exchanges on the network. $3.6b worth of exchanges occurred in 2021, up 803% from 2020. There were 326m transactions, up 68% from 2020. The transaction volume growth was largely driven by the exchanges on the network being worth more. Metrics have declined considerably in Q1. The number of transactions has slowed dramatically (+5%) and the value of exchanges has dropped 59%. The current daily metrics suggest the deceleration has continued.

Eth income statement

3.4m of eth was generated in revenue in 2021, up 127% from 2020. However, growth has decelerated in Q1 to 20%. Fees per transaction increased as demand for the network grew. The cost of issuing tokens to miners declined because the eth issued for new blocks was reduced from 3 to 2 eth at the beginning of 2019 and the burn mechanism was introduced in August 2021. The network is loss making, but is less loss making than it used to be.

USD income statement

The growth metrics in USD are amplified compared to eth denominated metrics. The USD metrics are driven by underlying fundamentals and the USD eth price volatility. The change in metrics in eth terms provide a more accurate picture. For example, the USD income statement suggests the network was less profitable in 2021 compared to 2020; a $9.5b loss in 2021 compared to a $1.5b loss in 2020. However, that was driven by the price of eth averaging $2,779 in 2021 compared to $307 in 2020. The eth income statement shows a different story. The network improved profitability in 2021; it lost 4m eth compared to 5m in 2020.

The Ethereum network operates in eth. Revenues and costs are denominated and paid in eth. Metrics are represented in USD because it is a familiar unit of measure and represents what can be purchased in the fiat world.

What do I actually own?

Owning eth tokens in a PoW consensus mechanism means owning:

Currency: eth is a currency within the Ethereum network that is used as a means of exchange. It is required to fund the cost of any activity on the Ethereum blockchain.

Speculative token: There is no fundamental value to eth while Ethereum is a PoW blockchain. Notwithstanding the Ethereum blockchain being a valuable technology, no value created accrues to eth token holders. As the Ethereum blockchain increases adoption and grows revenue, it still pays out all of its revenue to miners and issues more tokens to them. The rise in the price of eth is driven by speculation of what will come.

Does a blockchain need to be profitable?

Absolutely yes. Security of any blockchain is dependent on its miners. Miners are remunerated in the native token of the blockchain they are mining. If a blockchain is not profitable, if its native token has no means of accruing any of the value created on the blockchain, then why would a miner continue mining? They would be getting paid in a token that has no fundamental value and is propped up by speculation. Eventually, they will stop mining, security will be compromised, confidence will weaken, developers will stop developing dapps and the whole thing will unravel rapidly. Miners need to be paid in a token that has real fundamental value; not speculative value.

Ethereum, and all blockchains, need to have a path to profitability and a mechanism for eth tokens to directly benefit from the value created on the Ethereum blockchain.

WHAT THE merge!?!

Ethereum is converting to a Proof of Stake (PoS) consensus mechanism in 2022. The switch is referred to as “the merge” because the Ethereum blockchain that PoS has been tested on, called the Beacon Chain, will merge with the PoW blockchain. Thereafter, Ethereum will be a PoS blockchain.

PoS maintains the integrity of the blockchain by having validators “stake” 32 eth in order to validate the accuracy of inputted transactions. Staking is like a security deposit. If validators incorrectly validate a transaction, their 32 staked eth gets “slashed,” meaning they lose it.

It is a big deal because Ethereum PoS is:

More secure: It is costlier to mount a 51% attack to undermine the integrity of the blockchain. The attacker needs to own 51% of the staked eth, which is more expensive than buying the computing power required to mount an attack on PoW. Additionally, there are more validators in PoS than miners in PoW. Validators only need a computer, internet connection and eth; anyone can do it.

Better environmentally: Energy intensive mining operations are not required in PoS. Ethereum’s energy usage will decline by 99%.

Improved economics: Vastly lower token issuance, which makes the Ethereum network profitable. Eth token holders participate in the value created on the Ethereum blockchain.

New cost structure

The cost to operate the blockchain remain: i) ensuring its security and ii) processing inputs. But the method of remuneration is materially different. Validators are rewarded by:

Tips: Validators are paid part of the gas fees, referred to as the tip. Not the entire gas fee as was the case with PoW prior to EIP 1559 implementation.

New token issuance: Validators are issued new tokens for correctly validating transactions. The number of new tokens issued is based on the total amount of eth staked.

PoS Economics

The sliding scale used to determine how many new tokens are issued to validators serves as an incentive mechanism. The less total eth is staked across the network, the higher the yield offered to stakers to entice new validators to join. More validators increases security and transaction volume up to the network’s capacity limits. The staking yield is the total new tokens issued divided by the total staked tokens. It measures the annualized returns validators get on their staked eth. As more validators join, the yield decreases ensuring that the network does not overpay for additional security, which has diminishing marginal returns.

The Beacon chain has 13,115,244 eth staked by 391,152 validators earning a yield of 4.3%. The sliding scale staking yields are outlined in the table below. At 30m eth staked, validators will get a 3.3% staking yield and at 100m staked at 1.81% staking yield.

The table below outlines the economics for Ethereum PoS validators. The first assumption is the percent of eth that will be staked; 11-25% (13.6-29.8m eth). Based on the amount of eth staked, the max PoS token issuance can be inferred from the sliding scale formula from the table above and the staking yield implied; 3.0-4.5%. The second assumption is the fees the network generates, which drives the amount of eth burned. In addition to the tokens received for staking, the validators also get the tip; the portion of the transaction fees that are not burned. Combined, the two sum to the validators total earnings. The total earnings received by the validators implies a total validator yield of 4.7-5.7%.

Post Merge Ethereum Income Statement

The PoS Income Statement is materially different from the PoW Income Statement because the cost of operating the network is drastically reduced. By comparison, to generate 2,855 of daily eth revenue, PoW needs to issue 12,972 new eth, yet PoS only issues 1,678; an 86% reduction.

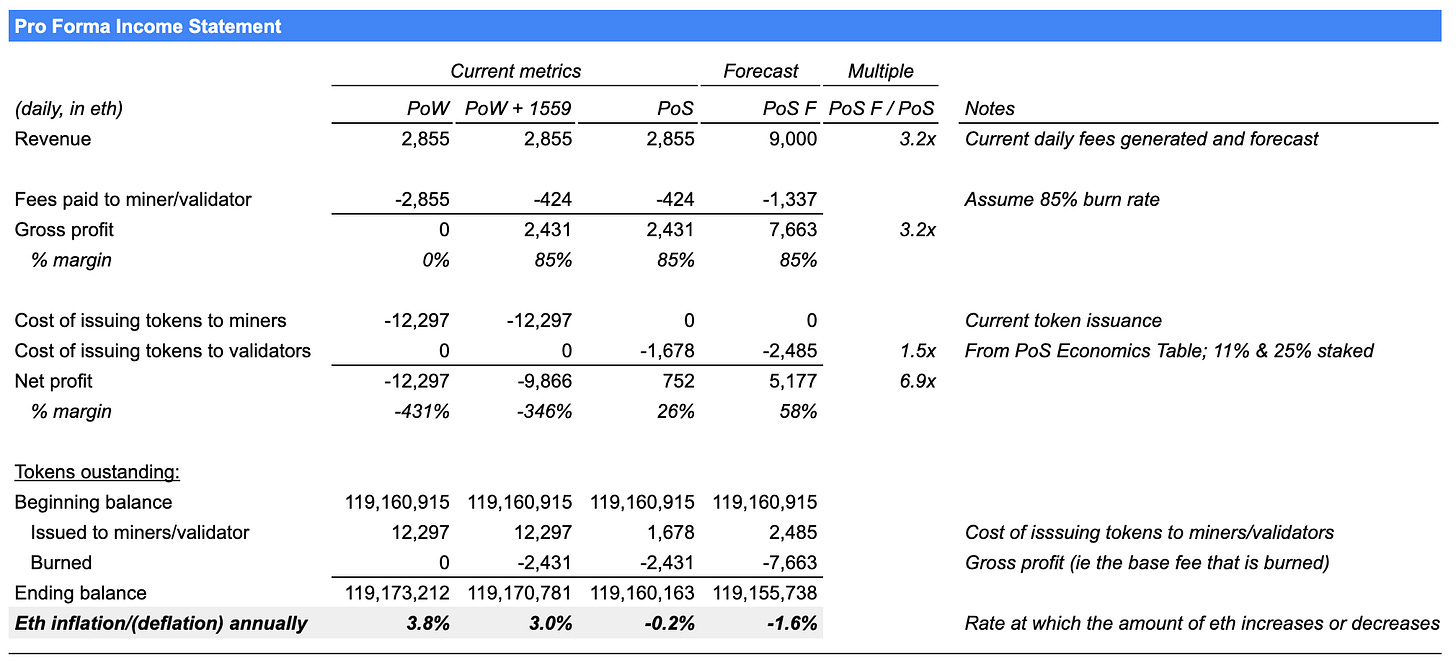

The table below illustrates a pro forma Ethereum Income Statement showing the change in profitability from PoW to PoW and EIP 1559, then to PoS. At the same revenue of 2,855 eth/day PoW has a net loss of 12,297 eth while PoS has a profit of 752 eth a 26% margin. If revenues increase to 9,000 eth/day, net profit increases to 5,177 eth, a 58% margin. Profitability improves by a factor of 7.9x while revenue grows at a factor of 3.2x because the issuance to validators only increased by 1.5x. In PoS, the cost of issuing new tokens to validators is driven by the amount of eth staked and not, like PoW, the number of eth transactions. As a result, Ethereum blockchain becomes profitable and the cost base highly scalable.

The profits in PoS accrue to eth token holders via the burn mechanism which reduces the number of tokens outstanding (shown as Eth inflation/(deflation) annually in the table below).

PoS is able to improve security and maintain transaction throughput at 1/7 the cost because it is more capital efficient than PoW and does not overpay for unneeded security.

The rewards in PoW go to the miner that can solve the cryptographic puzzle the fastest. It’s a race. To increase the chances of winning, miners use costly specialized high speed computers, which require a tremendous amount of energy. It’s capital intensive to buy the equipment and operationally expensive to run because of the energy requirement. Blockchain mining is akin to traditional resource mining; a lot of expensive equipment is needed, a lot of energy is expended and it’s terrible for the environment.

PoS is not a race. Validators are chosen randomly. High powered expensive computing doesn’t help. A basic personal computer, internet connection and eth is all that is required to be a validator. PoS strips all the capital and operating costs out of PoW.

Unlike PoW, PoS does not overpay for security. PoW pays 2 eth per block regardless of the number of miners. Security has diminishing marginal returns; meaning the additional security provided by the one billionth validator is far less than the security provided by the one hundredth. PoS pays for security proportional to the value that the additional security contributes to the network.

What do I own post merge?

Currency: Like in PoW, eth remains a currency used for exchange in the Ethereum ecosystem.

Economic asset: The eth token is akin to equity in a company. Eth token owners will share in the value creation of the Ethereum blockchain. The more use cases for Ethereum, the more demand to buy and use eth, the more eth price goes up. Simultaneously, revenue increases, which in turn reduces the number of eth outstanding. The value of the ecosystem increases while the amount of eth declines, driving up the value per eth token benefiting its holders.

Yielding asset: Eth owners can stake their eth and earn a staking yield.

Why is PoS a big deal economically?

1. Eth holders participate in value creation

The more value the Ethereum blockchain creates, the more the eth token benefits. The two are now directly linked.

2. Ethereum becomes profitable

PoS dramatically changes the cost structure, which makes Ethereum profitable.

3. Approaching max eth tokens outstanding

PoS significantly reduces the amount of eth issued and EIP 1559 continuously removes eth from circulation. The two forces combined mean the max number of eth tokens outstanding will likely be 120m reached in the fall of 2022 (assuming an August merge) and thereafter decline.

4. Structural sell market becomes a structural buy

Eth is plagued by being a market with a constant structural seller, miners. PoS and EIP 1559 reverses this and creates a structural buyer.

Miners receive eth and typically sell it to fund the cost of their dollar denominated mining operations. I estimate that 75% of the eth miners receive is sold. That creates a daily structural sell pressure of 7,269 eth, which equates to $13m at a $2,000 eth price. It means that every month $383m of eth is sold by miners and annually that’s $4.5b selling pressure.

Burning creates a synthetic buying pressure. It’s synthetic because eth is not being purchased in the open market. Instead, it is being retired from the base fee received. But the impact is still more demand for eth. I assume validators sell 10% of the tokens they are issued. Since the cost to validate is de minimus, there will not be a large sell pressure. The burn mechanism creates a daily structural buying demand of 2,248 eth or $4m at a $2,000 eth price.

The removal of the structural selling pressure from PoW miners and introduction of structural buying pressure from PoS and EIP 1559 means there will be a buying demand for eth of 9,516 eth or $17m, at a $2,000 eth price, on a daily basis; that’s 3.4m eth and $6.2b annually. That equates to 3% of the total eth outstanding and nearly 1% of the daily eth trading volume.

The merge has been long awaited. It materially changes Ethereum making it more secure, environmentally friendly and economically attractive for eth token holders. Ethereum will soon have an economic system that complements its technological innovation - it’s game changing.

hey Sam, great write-up -- I agree with the decreasing ETH sell pressure post merge, but I don't think blockchain value is derived from "profitability," but rather the demand to use the network

so while the merge will likely increase token price by lowering supply (token value = network value / tokens), I'd argue it doesn't directly impact network value