GMX: An Example of Fundamental Value

The Investment Case for GMX Token

GMX is a decentralized exchange (“DEX”) to trade perpetual futures contracts (“perps”), a crypto derivative. DEX infrastructure is an overlooked an unloved sector of crypto. Trading volumes have declined over 80% from the market peak. The DEX derivatives market is in its infancy. It is only 2% of the overall crypto derivatives market. Yet GMX has developed an ingenious way to trade perps. Its operating metrics are booming. GMX has grown earnings at a 230% CAGR over the last five quarters. Earnings are distributed to token holders. The GMX token trades at 12x earnings. The market is not pricing in GMX’s growth potential. An investment in GMX does not require a rebound in crypto trading volumes.

The GMX investment thesis is based on three pillars:

GMX benefits from structural tailwinds

GMX product is best in class

GMX has attractive economics

If GMX can continue to benefit from crypto trading volume shifting from Centralized Exchanges (“CEX”) to DEXs and spot trading shifting to derivatives trading, GMX could return 5.6x in a base case and 14x in a bull case.

This article details the investment case for GMX, outlines GMX valuation and explains where the thesis could fall short.

Disclaimer: authors of this article have positions in the tokens discussed. Read full disclosures below.

GMX investment thesis pillars:

1. GMX benefits from structural tailwinds

GMX benefits from two structural tailwinds:

i) Shift from CEX to DEX

Crypto trading is conducted on two types of venues: CEXs and DEXs. CEXs are similar to tradfi exchanges. They match buyers and sellers in exchange for a fee. Unlike tradfi exchanges, CEX’s custody client assets. DEXs do not match buyers and sellers directly, instead traders trade through a liquidity pool. A liquidity pool comprises of assets supplied by their owners in exchange for a fee. Traders trade their assets for one of the assets in the liquidity pool.

CEXs dominate spot and derivative traded volumes for three reasons:

Onboarding: Trading crypto first requires converting fiat into crypto. CEXs are the primary way to onboard fiat into crypto.

Longevity: Crypto assets have been traded on CEXs for nearly 15 years whereas DEXs came to market in DeFi Summer of 2020.

Execution: CEXs have historically offered faster and cheaper execution for large trades.

The table below highlights the largest CEXs and DEXs trading both spot and derivatives. Binance is the largest CEX. Derivatives trade in far greater volume than spot.

DEXs will take share from CEXs because:

No custody: Unlike CEXs, DEXs do not custody customers' assets.

Improving tech: DEXs are catching up to CEXs’ head start in two areas.

Onboarding: Emerging applications are enabling fiat onboarding directly onto DEXs. Stripe unveiled a fiat to crypto onramp in December 2022. The Stripe widget can be embedded in a DEX, wallet or dApp enabling users to fund their application of choice.

Slippage: The cost of using DEXs is ‘slippage’. Slippage is the difference between the expected and actual trade execution price. Slippage is a product of liquidity. Spot CEXs are 9x more liquid than spot DEXs. Derivative CEXs are 58x more liquid than derivative DEXs. The more illiquid an asset is on a DEX, the more the asset price will move upon trading and the more slippage is incurred. An economically motivated trader will compare the execution fees of trading on a CEX with the slippage cost of trading on a DEX when determining what exchange to use. Innovation has reduced DEX slippage, which in turn increases liquidity. Swapping 50 ETH for USDT on Uniswap v1 in 2020 cost 80 bps. Today on 1inch it costs about 10 bps to execute the same trade.

Competitive fees: Trading through DEXs is becoming competitively priced compared to CEXs after years of being more expensive. DEXs have a structural cost advantage compared to CEX. DEXs are protocols comprised of smart contracts that automatically execute trades. There is no intermediary. Yet their cost advantage has not benefited traders because of slippage costs. The decline in slippage is making DEXs more competitively priced compared to CEXs.

DEXs have already taken market share from CEXs (see chart below). This trend should continue and accelerate driven by improving DEX products, lower slippage and a shift to self-custody.

ii) Derivative DEXs are best positioned to grow

Derivative DEXs are poised to experience significant growth due to:

Large market: Derivative markets are larger than spot markets. Derivatives trade more frequently than spot. Derivative trading volumes are 355% the size of the spot market.

Small market share: Derivative DEXs are in their infancy. There are a few small players. Derivative DEXs combined have 1.7% of the CEX derivative volume (see chart below). Spot DEXs have 10.6% combined of the CEX spot volumes.

Permissionless and composable: DEXs, like all DeFi protocols, are permissionless and composable. DeFi protocols can program integrations with DEXs directly in their code. For example, Uniswap has over 300 integrations. DeFi protocols create a web of functionality to interact with each other. By comparison, integrations with CEXs are permissioned, costly and limited. If a DeFi protocol wants to integrate with Coinbase or Binance, it needs to establish a relationship, work with their development team, integrate an API, and be onboarded. It requires time and maintenance and can be rescinded.

Fallout from derivative CEXs: FTX was one of the largest derivative exchanges. Its collapse forced traders to reconsider trading on CEXs. The ongoing scrutiny of Binance, the largest derivative exchange, is causing further reconsideration.

2. GMX product is best in class

GMX is an anon DEX live on Arbitrum and Avalanche used to trade perps. Arbitrum is an Ethereum Layer 2 scaling solution. Avalanche is a Layer 1 blockchain competing with Ethereum. Trades on Arbitrum represent 82% of total GMX trade volume. GMX is essentially a way to trade perps on the Ethereum blockchain. Perps are derivative instruments that allow traders to speculate on the price movement of an asset without owning the underlying asset. Perps are native to crypto. Unlike tradfi futures contracts, they have no maturity date. They’re essentially a perpetual futures contract. The benefit of a perp is i) leverage, ii) ability to hold the position indefinitely and iii) a hedging instrument.

Six trading pair perps can be executed on GMX: ETH/USD, BTC/USD, LINK/USD and UNI/USD on Arbitrum and AVAX/USD, ETH/USD, BTC/USD and WBTC/USD on Avalanche.

A trader, for example, goes 5x levered long ETH by buying an ETH perp on GMX with a USDC. The perp is equivalent to buying 1 ETH at the spot price funded by USDC and getting 4 additional ETH at the spot price on margin. If the ETH price falls below a predetermined threshold, the trader is wiped out of his position. The trader pays a borrow fee to borrow the additional ETH. The borrow fee is paid to GMX liquidity providers.

Liquidity providers provide a basket of assets that traders trade against. The basket is called GLP. Approximately 55% of the basket is USDC, 25% is ETH and 20% is BTC. When the trader buys a 5x levered ETH perp, the GLP basket puts aside 5 ETH, the maximum that could be lost by the GLP basket and, conversely, made by the trader. If the trader went short ETH at 5x leverage, the GLP basket sets aside 5 ETH equivalent worth of USDC at the ETH price the trade was executed.

Liquidity providers contribute assets to the GLP basket in exchange for earning 70% of the trading fees the GMX protocol generates. There is a risk to being a liquidity provider. Liquidity providers are the counterparty to each trader. A trader’s loss is a gain for GLP liquidity providers and vice versa.

GMX design has five advantages:

i) No counterparty risk

The GLP basket sets aside the maximum amount of capital denominated in the correct asset that the trader could make on each trade. The trader is guaranteed to get paid out. There is no counterparty risk.

Tradfi exchanges and CEXs have counterparty risk. Counterparty risk was a dominant concern in the wake of the 2008 Global Financial Crisis. Fund managers hedged their portfolios by shorting securities through their brokers. But as brokers went down, they couldn’t make good on their trades. Shorting Lehman Brothers through Merrill Lynch didn’t work because they both went down. Centralized exchanges, in tradfi and in crypto, don’t have 100% of the capital on hand to fund all their trades. Their model is predicated on trades canceling each other out. It works most of the time, but in times of extreme market panic, counterparty risk is a concern.

Counterparty risks also exist on some DEXs. Liquidity pools can’t always pay out gains to traders. The most common design for a perps DEX includes a USDC pool for traders to trade against. A trader, for example, buys 200 ETH perps with 10x leverage at $2,000 ETH price. The notional position size is $4 million (200 x $2,000 x 10). The USDC pool the trader traded against has $10 million worth of USDC. If the price of ETH doubled to $4,000 the position is worth $8 million. The trader makes $4 million ($8 million current value - $4 million initial investment) less fees. The liquidity pool is now worth $6 million USDC. If the price of ETH quadruples to $8,000 the position is worth $16 million. The trader has made $12 million less fees. But the pool only has $10 million worth of USDC. The pool is $2 million short of paying the trader in full. GMX was the first protocol to solve this at scale by reserving assets one-to-one.

ii) 50x leverage

GMX offers up to 50x leverage. That’s an absurd amount of leverage. GMX is able to provide it because the GLP basket isolates the required asset upfront to fund the traders’ gains.

iii) Market based pricing

Trades are executed on GMX at the market price determined by Chainlink oracles. Traders trade at the most accurate price.

Tradfi exchanges and crypto CEXs match buyers and sellers directly in what is called a central limit order book. A central limit order book is the most efficient way to trade. The highest price a buyer is willing to pay and the lowest price a seller is willing to sell converge at the market clearing price.

Central limit order books don’t work for DEXs. Central limit order books require managing a large database capable of processing enormous transaction volumes. The Nasdaq processes 20,000 trades per second and receives many more that don’t get filled. No blockchain today is capable of processing throughput that large.

DEXs use liquidity pools instead of central limit order books. Traders trade against the liquidity pool instead of being matched with each other. Liquidity pools create price discrepancies.

Asset prices in liquidity pools are determined by the balance of the assets in the pool. Prices are not set by where a seller wants to sell and a buyer wants to buy, like a central limit order book. For example, if a trader trades $1 million of USDC for ETH in a liquidity pool with $10 million worth of ETH and $10 million of USDC, the price of ETH in the pool increases. The higher ETH price in the pool is not reflective of the actual ETH market price. The pool is reliant on an arbitrageur selling the higher price ETH in the pool. The arbitrageur’s sell pressure rebalances the price to the actual market price. It works. But it’s not instantaneous.

GMX’s asset prices are the correct market based prices. They are set by a Chainlink oracle price feed not liquidity pool dynamics. It means traders transact at the exact market clearing price. The same price they would transact at if they traded through a central limit order book.

iv) Zero-slippage

GMX eliminates slippage. Entire trades are cleared at the market price. Eliminating slippage makes trading more efficient and cheaper.

If a trader wants to buy 100 ETH perps, he would typically need to buy the first 20 at the market price, then the next 40 at a higher price and 40 more at an even higher price. The trader is constrained by the market depth of the specific pool.

On GMX, if the pool is big enough, the entire trade is executed at the market price. For example, all 100 ETH perps are traded at the Chainlink oracle price. GLP liquidity providers stand behind the other side of the trade at the market price.

v) Minimal fees and ease of use

GMX has similar trading execution fees and user functionality compared to CEXs. GMX charges traders 10 bps of the position size to open and close swaps and leverage trades. Binance also charges 10 bps on most of its trades. Perps can be traded with a few mouse clicks on either platform.

GMX is far more user friendly than DeFi alternatives. A levered trade can also be executed using DeFi applications like Compound for leverage and Uniswap to trade. A trader who owns ETH could use it as collateral for a USDC loan on Compound. The loan could be used to buy more ETH. The additional ETH acquired could be used to collateralize another USDC loan to fund even more ETH buying. These steps can be repeated multiple times to achieve the desired leverage. It’s doable but painful to execute. Instead GMX traders can put on levered trades using perps in one step. GMX is roughly the same price as the Uniswap and Compound example for smaller trades and more competitively priced for larger trade sizes.

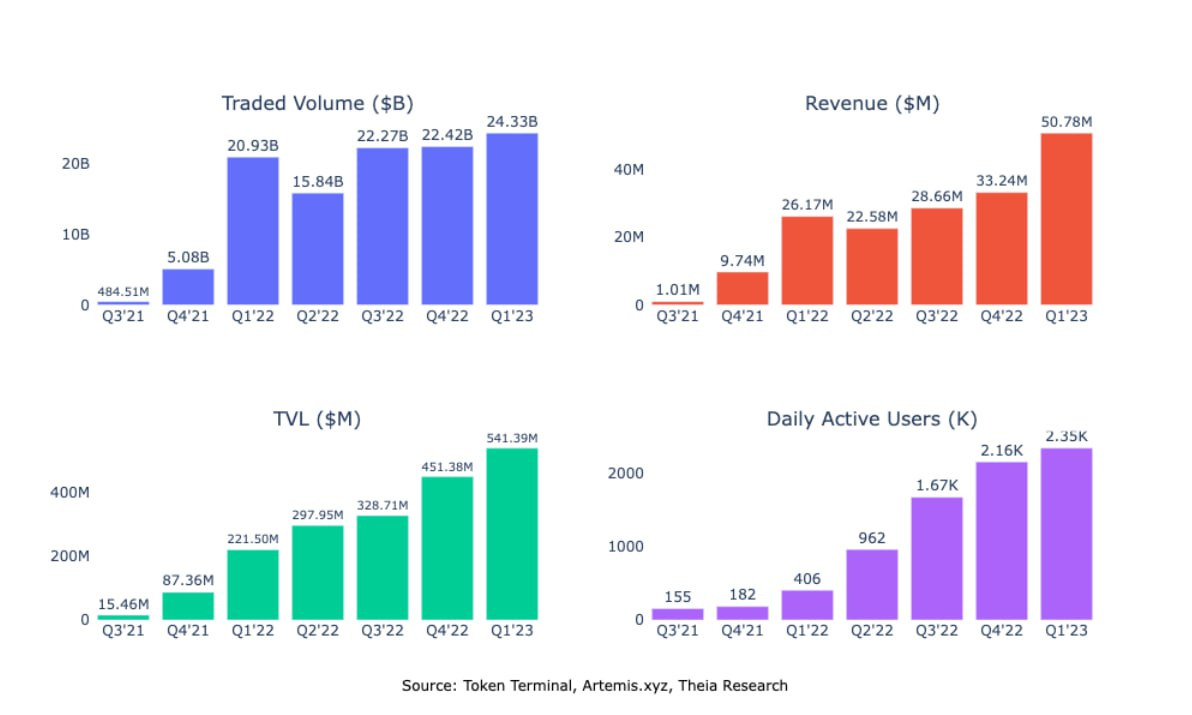

GMX’s attractive design attributes have driven growth in trading volume, and other metrics (see chart below), during a period where volumes across the market declined 80%.

3. GMX has attractive economics

The success of GMX is predicated on assets being contributed to the GLP liquidity basket. Supplying assets to the GLP basket offers attractive returns. The attractiveness of GLP in turns drives the GMX token economics.

GLP economics:

GLP returns are driven by two things:

a) Trading fees

Fees are composed of trade execution fees and borrow fees. Fees for trades executed on Arbitrum are paid in ETH. Trades executed on Avalanche are paid in AVAX. The vast majority of fees are denominated in ETH since 82% of GMX trade volume occurs on Arbitrum. GLP liquidity providers receive 70% of the fees generated. They have generated approximately a 25% annualized return each month this year (see table below).

b) Inverse of trader P&L

GLP liquidity providers are exposed to the inverse of the combined traders’ P&L. If the combined P&L for all traders on GMX is positive, then the value of the GLP basket has declined by a commensurate amount and vice versa.

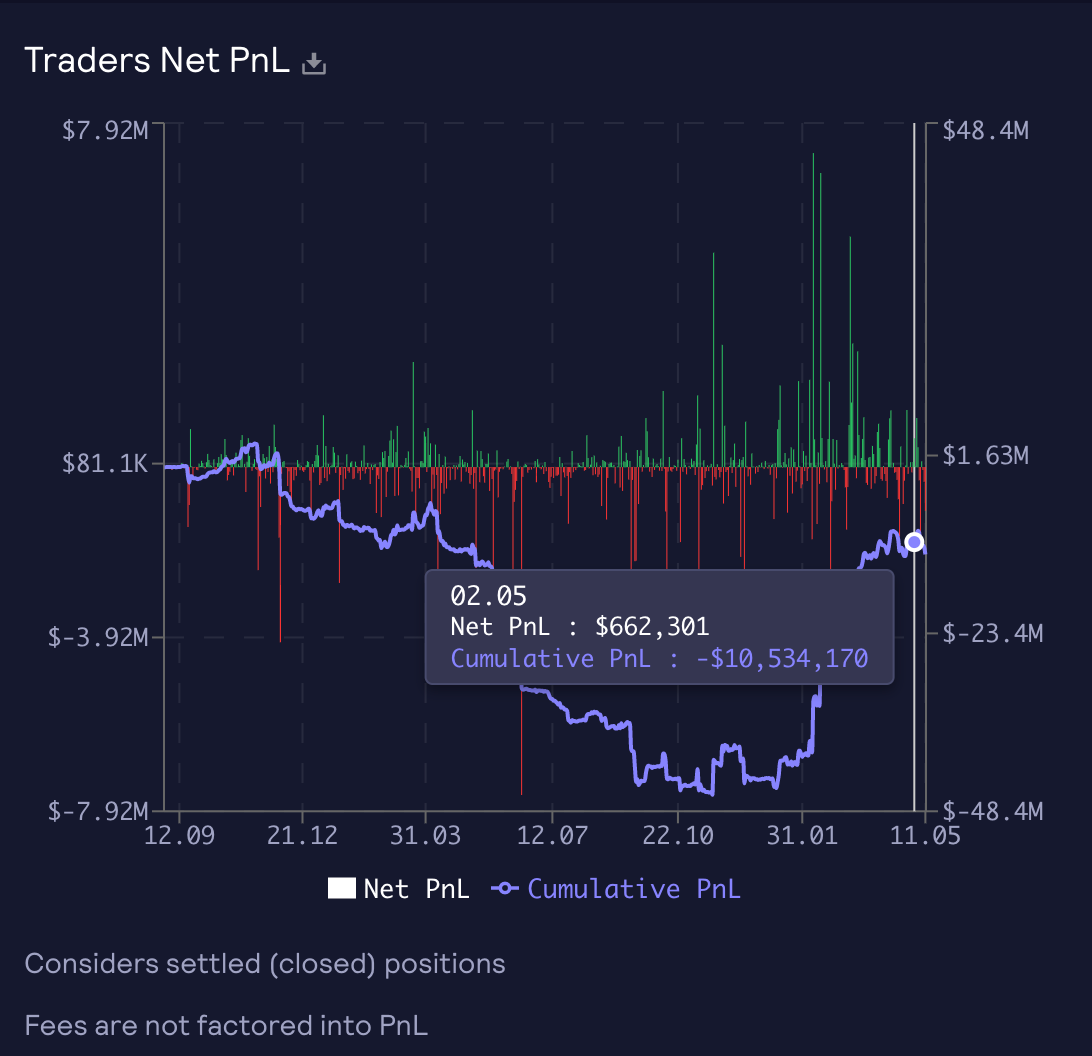

GLP providers have benefited twofold i) from the fees, ii) from the increase in value of the GLP pool as a result of trader losses. Since inception traders have lost a cumulative $10 million (see chart below).

GMX economics:

The GMX token is the governance token of the GMX protocol. Token holders also get 30% of fees. It’s essentially a dividend. The GMX token trades at the equivalent of an 8% dividend yield and 12.4x earnings and has grown earnings at a 230% CAGR over the last 5 quarters. The GMX protocol has no operating costs. Its revenues are equivalent to its earnings.

There are 8.7 million GMX tokens outstanding. A maximum of 13 million tokens can be issued. There are two factors that alleviate the 50% token inflation. First, it’s factored into the fully diluted market cap that implies GMX’s 12.4x earnings valuation. Second, new token issuance is mostly for rewards for GMX holders, facilitating liquidity and development. GMX token holders can earn additional GMX tokens the longer they hold their GMX tokens and the more actively they trade on GMX.

Only 6% of GMX tokens are locked. There is no major sell pressure coming.

So what’s GMX worth?

Valuing GMX is straightforward. Total protocols fees can be forecasted based on overall market growth and share gains. Revenues to GMX token holders are derived from total fees. The revenues, which are equivalent to earnings, are paid to GMX token holders.

GMX revenue can grow in two ways. First, crypto trading volume growth. If crypto trading volumes rebound from their trough to their prior peak levels, GMX would see a flurry of activity. It’s a macro bet. Second, is share gains. GMX’s revenue can grow substantially from share gains. The investment in GMX is not predicated on crypto trading volume rebounding. There are three ways GMX could gain share:

DEX derivative market takes share from CEX derivative market: Derivatives traded on DEXs represent 1.7% of the total derivatives traded on CEXs. By comparison, spot traded on DEX represent 10% of total spot traded on CEXs. Derivatives traded on DEX should increase their share toward 10%.

DEX derivatives market takes share from the DEX spot market: The derivatives traded on DEXs represent 58% of the total spot volume traded on DEXs. By comparison, the derivatives traded on CEXs represent 350% of the spot volume traded on CEXs. The DEX derivative market should become bigger than the DEX spot market.

GMX takes share from competitors: GMX has 8% market share of the derivatives volume traded on DEXs. GMX could take share from competitors.

The illustrative valuation below sensitizes overall market volume growth and the three avenues derivative DEXs and GMX can take share. The resulting GMX revenue is forecasted and capitalized. In the bear case, overall crypto trading volumes decline 30% and GMX loses share. Earnings are capitalized at 10x resulting in 57% decline in GMX token price. In the base case, there is no crypto trading volume growth, derivative DEXs gain share and earnings are capitalized at 20x resulting in a 5.6x investment. In the bull case, there is 10% crypto trading volume growth, DEX’s gain share and earnings are capitalized at 20x resulting in a 14x return. The bull case highlights how much GMX can gain from narrowing the gap between DEX derivative market share relative to CEX and spot comparables.

How could the thesis be wrong?

Investing in GMX is not without its risks. There are four reasons why the GMX investment thesis may not play out. Each reason has its own mitigants. An investment in GMX may not work out because:

i) Declining crypto volumes

GMX is worthless if trading of crypto assets or derivatives ceases. A material decline in volumes would negatively impact the value of GMX token.

Mitigants:

Material declines already experienced: Crypto trading volumes on CEXs and DEXs have declined 85% and 80% respectively from their peaks in May 2021 to April 2023. Trading volumes are closer to their trough than peak. Trading volumes in 2023 appear to have stabilized. The chances of another material decline is limited.

Trading volume rebound is not necessary: An investment in GMX is not predicated on crypto trading volume rebounding from the trough.

ii) GLP liquidity providers incurring large losses

GLP liquidity providers are critical to the GMX protocol. Traders have no one to trade against without GLP liquidity providers. If GLP providers get wiped out from losses to traders the liquidity pool dries up, no new capital gets provisioned, the protocol becomes useless and the GMX token has no value.

Mitigants:

GLP getting wiped out is a tail risk event: GLP liquidity providers risk losing the capital they contributed in the event that traders are positioned levered long and the market rallies. Alternatively, if traders are positioned short and the market pukes, GLP liquidity providers lose their capital. Notwithstanding a 70% market drawdown in 2022 followed by a 60% upswing in 2023, GLP providers have made $10 million in gains resulting from trader losses.

GLP providers can hedge the trading P&L exposure: By hedging the trader P&L, in a tail risk event where the GLP provider loses the capital contributed to GLP, they make money on their hedge. GLP providers who hedge the trader P&L earn have earned 15-20% returns compared to unhedged GLP providers who earn 25%.

iii) GMX is deemed a security

The GMX token could be construed as a security by US regulators. GMX has attributes of a security, namely an expectation of profits. If GMX was deemed a security in the US, the token price could face a material impairment along with the broader crypto market. Americans could not own the GMX token. US based exchanges could not trade it.

Mitigants:

Not necessarily a security: GMX has attributes that suggest it may not be a security, namely decentralization. To be deemed a security the expectation of profits needs to come from “the efforts of others.” The GMX protocol is simply lines of code that operate autonomously. The code generates a profit, which is distributed to token holders. It’s less evident in the case of GMX that the profit comes from the efforts of others.

No impact outside of US: The US deeming GMX a security does not impact its usage outside of the US.

iv) Competitive entrants in an open source environment risk undermining GMX

The structural tailwinds benefiting derivative trading on DEXs have surfaced significant competition. GMX and its competitors including dYdX, GNS and Level Finance are open source protocols meaning that anyone can copy their code, repurpose it and tweak it. The barriers to entry are low.

Mitigants:

Rising tide lifts all ships: All derivative DEXs stand to benefit from the massive share gains that will come from CEX volumes moving to DEXs and spot volumes moving into derivatives. The market will grow dramatically before competitors fight each other for share.

dYdX: dYdX is the largest DEX for derivatives. Since the beginning of the year an average $35 billion per month of volume is traded on dYdX. Unlike other DEXs, dYdX uses a central limit order book. The user experience is similar to trading on a CEX. The drawback to dYdX is that it’s not decentralized. Large portions of the order book run on local servers. dYdX is migrating from Ethereum to a Cosmos app chain in hopes of running its central limit order book entirely on chain. Running a central limit order book on chain has evaded developers because no chain has the necessary throughput yet. dYdX is an ambitious project. Its success on Cosmos is unclear.

Gains: Gains has traded an average of $3.6 billion of volume per month since the beginning of the year. Gains competes with GMX by offering more trading pairs. Gains offers 90 trading pairs compared to 6 on GMX. Gains’ counterparty risk design enables it to offer less liquid trading pairs. Its counterparty risk model caps a traders gain at 9x. The drawback for the trader is capped gains, compared to uncapped gains on GMX. The benefit is trading pairs that aren’t available on GMX. The market will likely evolve to GMX dominating large liquid token pairs (eg BTC, ETH) and Gains dominating less liquid pairs.

Level Finance: Based its model on GMX. It launched in January 2023 on Binance Smart Chain. Level Finance traded $6.7 billion of volume in April. Level Finance introduced liquidity provisioning tranching. Like mortgage-backed security tranching, liquidity provisioning tranching allows capital providers to underwrite different risk levels. For example, if a trader earns $100 against the Level Finance liquidity providers, the Junior Tranche liquidity providers will pay $50 while the Mezzanine Tranche pays $30 and the Senior Tranche pays $20.

GMX best positioned: GMX represents the best decentralized derivative DEX in the market today. GMX community is developing product enhancements, such as GMX v2, which would reduce price data feed latency.

Tying it all together

GMX is a compelling investment opportunity. The market has overlooked DEX derivative trading infrastructure. GMX can be bought for 12x earnings. Its earnings are growing at 230% CAGR. The earnings are distributed to token holders. Derivative DEXs are at the precipice of facing a wave of activity as they take share from CEXs and the spot market. Based on reasonable assumptions on market share gains, guided by existing benchmarks, GMX can generate a 5.6-14x return.

Stay curious.

Don’t forget to hit the “♡ Like” button!

♡ are a big deal. They serve as a proxy for new visitors and feed into Substack’s algorithm that distributes my articles to all Substack readers.

And if you’re feeling real good…share this article

Follow me on Twitter for my latest takes @samuelmandrew

Disclaimer

This article (“Article”) has been prepared for informational purposes only.

At the time of this writing, Crypto Clarity, Theia Blockchain LLC (“Theia”), and their affiliates hold positions in GMX.

While the information provided herein is believed to be accurate and reliable, none of Crypto Clarity, Theia, or any of their respective affiliates or representatives or any other person makes any representations or warranties, express or implied, as to the accuracy or completeness of such information. No representation or warranty is made as to the continued accuracy of this information after the date of this Article. This Article does not purport to contain all of the information that may be required to evaluate a potential investment. Any recipient hereof should conduct its own independent analysis of the data contained or referred to herein. In furnishing this Article, no parties involve undertake any obligation to update the Article or to provide the recipient access to any additional information.

This Article is not an offer to sell or a solicitation of an offer to buy any security of a fund managed by Crytpo Clarity, Theia, or any person. An offering of the security described herein, if any, will be made pursuant to a definitive offering documents and the information contained therein together with a subscription agreement and related documentation will supersede the information herein in its entirety.

Impressive information gathered up. Definitely the derivatives market is one of the promises in this ecosystem, we will see how it evolves. Congratulations for the information provided regarding the pros and cons of GMX.