Freezing Celsius

A freezing crypto winter. Likely Celsius Network insolvency. A large crypto hedge fund liquidating. I explain what happed to Celsius, why it's a big deal and what to look out for.

A freezing crypto winter

Total crypto market cap declined 25% in the past week and is now down 69% from its peak erasing nearly $2 trillion of market cap.

Four factors came together simultaneously leading to the latest crypto market rout:

1. Macro

On Friday June 10, 2022 markets got whacked as US inflation was reported at 8.6%, which was ahead of expectations and indicated inflation reaccelerated. Lately moves in equity markets are amplified in crypto markets. Since crypto trades 24/7 the crypto selloff continued over the weekend, which is when rumors of Celsius’ insolvency surfaced.

2. Celsius catastrophe

Celsius Network, which provides crypto yields and loans to 1.7m users, appears to be insolvent. On June 12, Celsius halted depositor withdrawals. At its peak, it self-reported $28 billion of assets. It has hired restructuring advisors. It has large BTC and ETH derivative positions. Investors panicked and sold in anticipation that Celsius would liquidate its investments. State securities regulators in six states are investigating Celsius’ decision to suspend customer redemptions.

3. Binance halts withdrawals

On Monday June 13, Binance, the largest crypto exchange, halted bitcoin withdrawals because of “stuck on chain” transactions. Three and a half hours later, withdrawals resumed. The news further panicked the market.

4. Three Arrows Capital liquidation

Giant crypto hedge fund Three Arrows Capital (“3AC”) is getting positions liquidated. 3AC’s asset base is an estimated $10-18 billion. They are speculated to be in trouble making margin calls; a death sentence for hedge funds. It’s a big deal because 3AC is one of largest borrowers. Defaulting on their loans, or the anticipation of it, are sending reverberations throughout the market.

Celsius’ temperature

Celsius is a Centralized Financial (“CeFi”) platform that allows its users to deposit crypto, trade and make crypto-backed loans. Like traditional finance ("TradFi”) institutions, Celsius takes custody of its users' assets. Users flocked to Celsius because it offered a whopping 18.63% annual yield on crypto deposited on its platform. In the fall, Celsius raised $750 million in its Series B valuing the business at $3.5 billion, 5 years after it was founded.

To generate nearly 19% yields for depositors, Celsius invested its users' deposits in illiquid crypto investments and used leverage. Celsius mismanaged the duration of their investment and deposits. They have short term deposits. Their users can withdraw daily. Yet they tied up the deposits in long term illiquid investments and used leverage. It’s a recipe for disaster that is now unfolding. They were able to do this because they’re unregulated.

Celsius’ 3 problems: transparency, leverage and illiquid investments

Problem 1: Transparency

We don’t know what Celsius’ balance sheet looks like because it is a private unregulated company that does not disclose financials and not all of its transactions are on chain. In October 2021, it announced “total assets” crossed $28 billion. In December 2020, Chainalysis did an on-chain audit of Celsius revealing $3.3 billion assets. No audit has been done since.

Celsius's asset base today must be much lower because crypto markets have declined 70% from their Q4’21 peak and users have withdrawn an estimated $1.2 billion of deposits in May in the wake of the Luna crash.

Celsius equity value is what is critical for its solvency. Equity value is the difference between its asset value and debts. By reviewing Celsius’ on-chain wallets, analysts estimate Celsius currently has $3.5 billion of assets and $1.1 billion of liabilities, netting an equity value of $2.4 billion. However, these numbers are purely estimates trying to peer into a black box and do not capture off-chain assets and loans.

What we can see with more certainty is the dire shape of Celsius’ large outstanding loan and illiquid investment. Coupled with Celsius June 12 announcement that it was blocking all withdrawals, the outlook is bleak.

Banning deposit withdrawals is a really big deal. Imagine your bank announced it was banning you from withdrawing your money until further notice. Panic ensues.

Problem 2: leverage

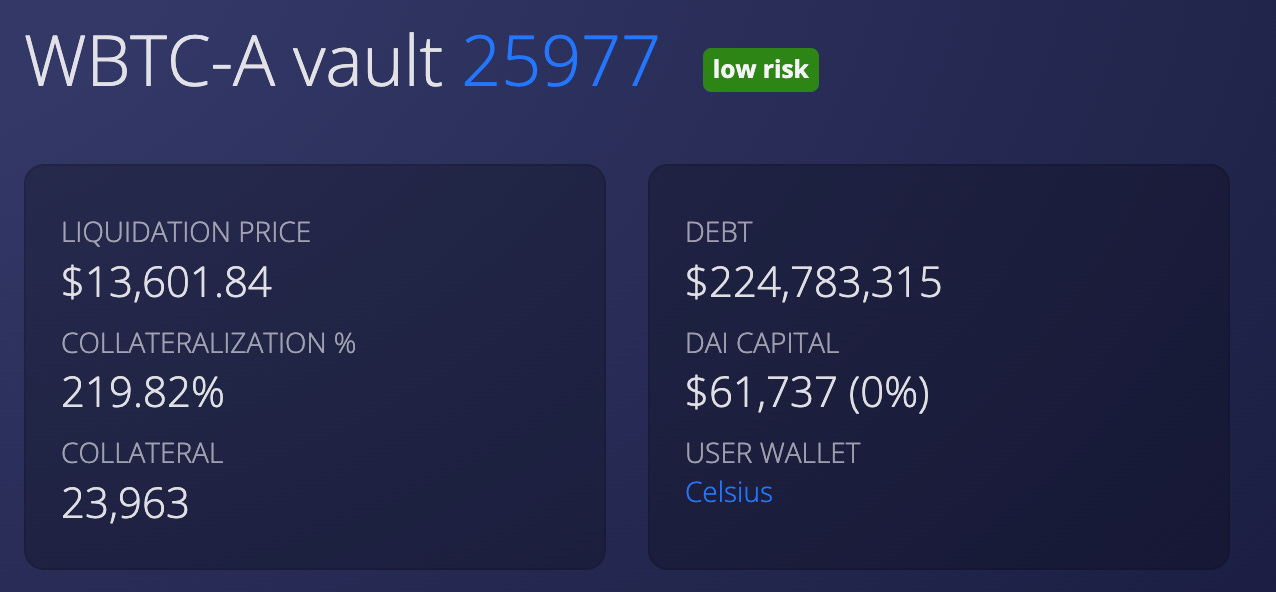

As of June 13, Celsius had a $276 million DAI stablecoin loan through DeFi protocol MakerDAO. Maker is a collateralized lending protocol. Borrowers, for example, can put in $150 worth of volatile crypto assets and get a loan for $100 worth of DAI stablecoin. If the value of the collateral in this example falls below $150, the borrower either needs to add more collateral or the loan gets repaid instantly. The collateral used for the $276m Celsius loan is wrapped BTC (“wBTC”). wBTC is a fungible token that represents BTC on the Ethereum blockchain. 1 BTC = 1 wBTC.

As of June 12, the BTC liquidation price on the loan was $22,534; meaning if BTC falls to $22,534 the collateral securing the $276m loan is automatically sold and the loan is repaid. To prevent that, Celsius needs to preserve the 150% collateralization ratio by either repaying the loan or adding more collateral.

As the BTC price started to fall to the low $20k’s, Celsius added more collateral and repaid part of the loan multiple times from June 12-14. As a result, the BTC liquidation price is now $13,601 and the collateralization ratio is 220%.

Celsius now has 23,963 wBTC, worth $494 million, securing a $225 million loan. It avoided implosion; at least for now. We can tell from on-chain movements, that Celsius added 7,208 wBTC worth roughly $150 million of collateral to support the outstanding loan and repaid $47 million worth of the loan. Celsius started adding more collateral June 11, the day before it banned deposit withdrawals.

Although it’s not certain, it is likely that Celsius has banned customer withdrawals in order to use the depositors’ funds as additional collateral against Celsius to prevent Celsius from going bankrupt.

Celsius made a calculated move to add collateral to the loan instead of repaying it. It would do that for two potential reasons:

Not enough funds: It requires less capital to top up the collateral than repay the full loan amount. For example, $170 of wBTC is used to collateralize $100 of DAI stablecoin; a 170% collateralization ratio. The price of wBTC drops 25% so the value of the collateral is $128 (and a 128% collateralization ratio), the borrower needs to come up with $22 worth of wBTC as collateral to get the collateralization ratio back to 150%, which is less than the $100 to repay the loan. In reality, the loan gets automatically repaid once collateralization ratio drops to 150%, which is why Celsius was adding collateral in drips to prevent an automatic loan repayment. Adding collateral suggests Celsius may not have the available capital to repay the total loan.

Resurrection gamble: By adding collateral, Celsius is hanging on another day. They are likely insolvent, but there is not yet a trigger for bankruptcy. Given Celsius’ financial position, regulators swarming, potentially defrauding depositors and Celsius hiring restructuring advisors, a bankruptcy seems inevitable. However, without a trigger, the current limbo can drag on.

Problem 3: stETH illiquid investment

Celsius owns 409,305 of illiquid staked ETH (“stETH”) worth $472 million. stETH allows anyone to earn ETH staking yields without setting up staking infrastructure. Additionally, stETH can be lent out or liquidity provisioned allowing the stETH owner to earn an additional yield. The drawback is that stETH cannot be redeemed for ETH until 6-12 months after the merge, which has not yet happened.

stETH can be exchanged for ETH on the open market through liquidity providers. The largest of which is Curve. However, there is only 490,294 stETH of liquidity on Curve, yet Celsius owns 409,305 stETH. They can’t possibly sell that much stETH. Celsius can’t sell the amount of stETH they own, plus they can’t redeem it for ETH; it's an illiquid investment.

Furthermore, stETH, which previously could be traded for 1 ETH, now is trading for 0.94. Furthermore, Celsius stETH is also pledged as collateral for $205 million USDC stablecoin loan.

It’s a big deal

Celsius has a dwindling equity value. The value of its assets has come crashing down with the market, but the value of its liabilities, denominated in USD stablecoins, has stayed the same. It just barely missed having its $276 million DAI loan automatically redeemed. On-chain analysis suggests that only 29% of Celsius on-chain assets are liquid. If or when withdrawals are allowed, it will be a stampede for the door and Celsius doesn’t have the liquidity to give depositors and lenders their money back. That’s why they banned withdrawals and hired restructuring advisors to figure out what to do.

Celsius’ likely insolvency is a big deal because:

Forced selling of assets: Celsius could be forced to sell assets at distressed prices, pushing the market down even more. The anticipation of this is enough to send prices down.

Contagion: Luna’s collapse followed by Celsius’ perils sends shockwaves across the market. Unlike prior crypto market crashes, the complex system of derivatives and leverage enmeshes everyone. The liquidation of 3AC exemplifies how far reaching the impact is.

Another black eye for crypto: Regardless of Celsius’ fate, the position it has put depositors and lenders in has dealt another black eye to crypto. It mismanaged its assets and liabilities. It calls for further regulation.

The race against time

It’s a race against time for Celsius. They hope crypto price can rebound and the Ethereum merge is successful, which will allow their stETH to be redeemed for liquid ETH, before regulators, insolvency and class action suits from depositors take them down. In the meantime, I suspect employees will abandon ship. The chances of threading the needle are low. I suspect Celsius is over.

Lookout for:

Celsius restructuring process

Celsius will not be resolved overnight. There is no trigger to force an immediate bankruptcy. It will likely drag on. Celsius is a Delaware registered business. As such, bankruptcy law does apply to it. I suspect Celsius will pursue a restructuring process whereby it will agree to divvy up whatever asset value is left over amongst stakeholders. Securities held on behalf of depositors by registered brokerages, like Fidelity, cannot be touched in a bankruptcy proceeding. However, Celsius is not a registered brokerage. People who deposited money in Celsius will likely be treated as unsecured creditors with limited legal protection. Unfortunately, that means these depositors could lose most or all of their money because they will be at the bottom of the list of stakeholders to get repaid with whatever asset value is left over if any. Those who lent money to Celsius may fare a little bit better because there is collateral against loans made to Celsius. They would be secured creditors. But the value of Celsius collateral is deteriorating as markets collapse. How much gets attributed to who will be fascinating to see in the likely first large crypto restructuring process.

Margin calls / deleveraging

A margin call happens when the lender, whose capital was used to buy assets, wants their loan repaid because the value of the asset it was used to buy no longer comfortably covers the value of the loan. When this happens simultaneously across the market, it triggers a cascading effect. Facing margin calls, investors are forced to sell, pushing prices down, which causes other margin calls, which causes more forced selling. On and on it goes. It’s called deleveraging. It’s violent.

3AC struggling to make margin calls is a big deal because they are a large crypto borrower. Their tentacles spread to every crypto lender, who like dominoes falling, will be calling back loans from 3AC. In anticipation of this, market participants will be dumping the same holdings as 3AC to save themselves. The person who panics first can fare better and sell out at better prices than the person who panics last. If they are able to, the investors in 3AC will withdraw their capital forcing yet more selling to meet redemption calls. Lenders will be pulling money they lent out to protect their own solvency. When there is less credit in the system, there is less money chasing the same number of coins; coin prices decline.

When market wide deleveraging happens, as we’re seeing now, people sell their most valued and liquid assets first - BTC and ETH - because they’re more liquid and, until recently, on a relative basis to alt-coins had not fallen as much. During the global financial crisis of 2008, a similar dynamic occurred. A market wide deleveraging caused the prices of investment grade bonds, which are the most secure and senior debt, to fall below the prices of low grade bonds, which are unsecured junior debt. Investors needed to meet margin calls and derisk. There was no market for their low grade bonds; literally no one wanted to buy them. They had to sell their high grade bonds; it was the only thing they were able to sell.

stETH/ETH trading below 1:1

stETH / ETH trading below 1:1 is a potential asset/liability mismatch that could further threaten crypto markets.

Investors got long stETH because it was a way to put ETH to work and generate a yield. Leverage was used to amplify this trade. It’s what is known in TradFi as a carry trade; borrow at a low interest rate (in this case borrow in ETH) and invest the borrowed capital in higher yielding investments (in this case stETH). It works until it doesn’t. The problem with this trade is that you own an illiquid investment (stETH), but your liability is ETH that can be called at any time.

As the price of stETH drops, margin calls start happening, but as explained, there is not much liquidity in the stETH market. So those who have this trade on could have to sell something else, likely ETH and BTC.

There is not a dull market in crypto markets.