Ethereum Q3'22: State of The Network

Q3'22 results: deteriorating fundamentals & improving profitability

“Ethereum revenue declined 70% year-on-year in Q3’22. It successfully executed the merge; a monumental feat. Ethereum’s results are a tale of two stories: deteriorating fundamentals and dramatically improving profitability.”

That would be the quote if Ethereum issued quarterly results.

This article serves as Ethereum’s Q3’22 results. It’s broken into two sections:

The Merge (a quick recap)

“Fait accompli”

Market reaction

Economic impact (in one chart)

Ethereum’s State of the Network

Operating metrics

Income statement

What does it all mean?

The Merge

Fait accompli

The merge was executed flawlessly on September 15 at 6:42:42 UTC. No glitches. No downtime. From one block to the next, Ethereum went from Proof of Work to Proof of Stake. (For a detailed understanding of the merge, read The Business Case for Ethereum and Merger Mania.)

The merge provides 4 benefits:

Improved economics: A 90% reduction in token issuance, which dramatically improves Ethereum’s profitability. The profit of the network is redistributed to token holders via the burn mechanism.

Better environmentally: Energy intensive mining operations are not required in PoS. Ethereum’s energy usage declined by 99%.

More secure network: It is costlier in PoS than PoW to mount a 51% attack to undermine the integrity of the blockchain.

Foundation for Ethereum scaling: The merge does not scale Ethereum. It does, however, lay the foundation to scale Ethereum. It splits Ethereum into an execution layer and consensus layer. Both layers will be scaled independently. The benefits of which compound each other (read Ethereum can’t scale…or can it?).

Market reaction

“Large cap” crypto, along with the Nasdaq, nearly all hit their lows by June 18 and rallied to a recent high by August 15. The rally was a bear market bounce driven by:

Decent Q2 results for US corporates

Easing inflation expectations

Slight easing of rate hike expectations

Markets retraced their summer gains by September because:

Higher than expected CPI print of 8.3% on September 13

Fed Funds rate hike of 75 bps

A shift back to an expectation of continued aggressive rate hikes

In the summer rally, Eth was further boosted by the imminent merge. Subsequently, Eth was impacted by the macro backdrop in addition to:

Miners selling their Eth

Those that bough Eth pre-merge to flip airdropped EthPoW sold their Eth

Speculators dumped their Eth given no major price appreciation post merge

Macro backdrop continues to dominate credit, equity and crypto markets. The impact of the merge was not sufficient to overcome the deteriorating macro environment.

Economic impact

The economic impact of the merge is encapsulated in one chart.

Since 2019 Ethereum has issued roughly 14,000 eth tokens a day to miners. Throughout 2022, depending on the $ price of Eth, 14,000 eth tokens equated to $15-50 million. Assuming miners sold 75% of the tokens issued to them to cover their operating expenses, Ethereum experienced a daily sell pressure of $11-38 million a day.

In PoS, about 1,500 gross new tokens are issued daily to validators. The cost of securing Ethereum has decreased by 90%.

The economic impact of the merge cannot be understated. The number of Ethereum tokens outstanding went from inflating at 4% per year in PoW to 0% in PoS. As demand for blockspace grows, the number of Ethereum tokens outstanding will decline.

The State of the Network

Operating metrics

The Ethereum blockchain operating metrics are decelerating and declining. It’s concerning. Deceleration is common after periods of rapid growth. However, it indicates slowing demand for Ethereum blockspace. The deteriorating fundamentals are due to two factors:

Competition from other blockchains

Declining usage from peak euphoria

Commentary on operating metrics:

Unique addresses: The number of unique addresses has decelerated to 20% year-on-year (“yoy”) growth from prior rates of over 40%. It indicates that fewer new people are coming into the Ethereum ecosystem.

Daily active eth addresses: This figure is volatile. It follows boom and bust cycles. In Q1’22 it turned negative. It deteriorated further in Q2’22. In Q3’22 it stagnated. It indicates that people within the Ethereum ecosystem are using it less. In the last five days, there has been an increase in daily active eth addresses. Perhaps it's an early signal of improvement.

Average daily transactions: This figure is declining along with daily active eth addresses. It indicates that people are transacting less than they used to.

Eth staked: Continues to grow at a rapid clip. It should continue as more stakers secure the Ethereum network.

Commentary on market statistics:

Transaction volumes (USD): This figure is highly volatile because it is driven by the number of transactions and the underlying Eth USD price. It is often quoted, but less relevant to assess the underlying health of Ethereum.

Transaction volumes (Eth): Transaction volumes have declined 30-60% yoy since the Q3’21 peak. The rate of decline has slowed to -16% yoy. Transactions volumes have declined significantly because of the compounding effect of deteriorating operating metrics. There are fewer new people coming to Ethereum. Users transact less frequently. When they do transact, they transact in lower amounts.

Commentary on DeFi metrics:

TVL (USD): Like transaction volumes in USD, this metric does not grasp the underlying health of DeFi. It is highly volatile because it is driven by Eth USD prices and the number of Eth tokens locked. The decline is largely due to the decline in Eth price.

TVL (Eth): After a parabolic increase in H1’21, the figure has stabilized. It indicates that notwithstanding cratering Eth prices, people have kept their Eth in DeFi.

Income statement

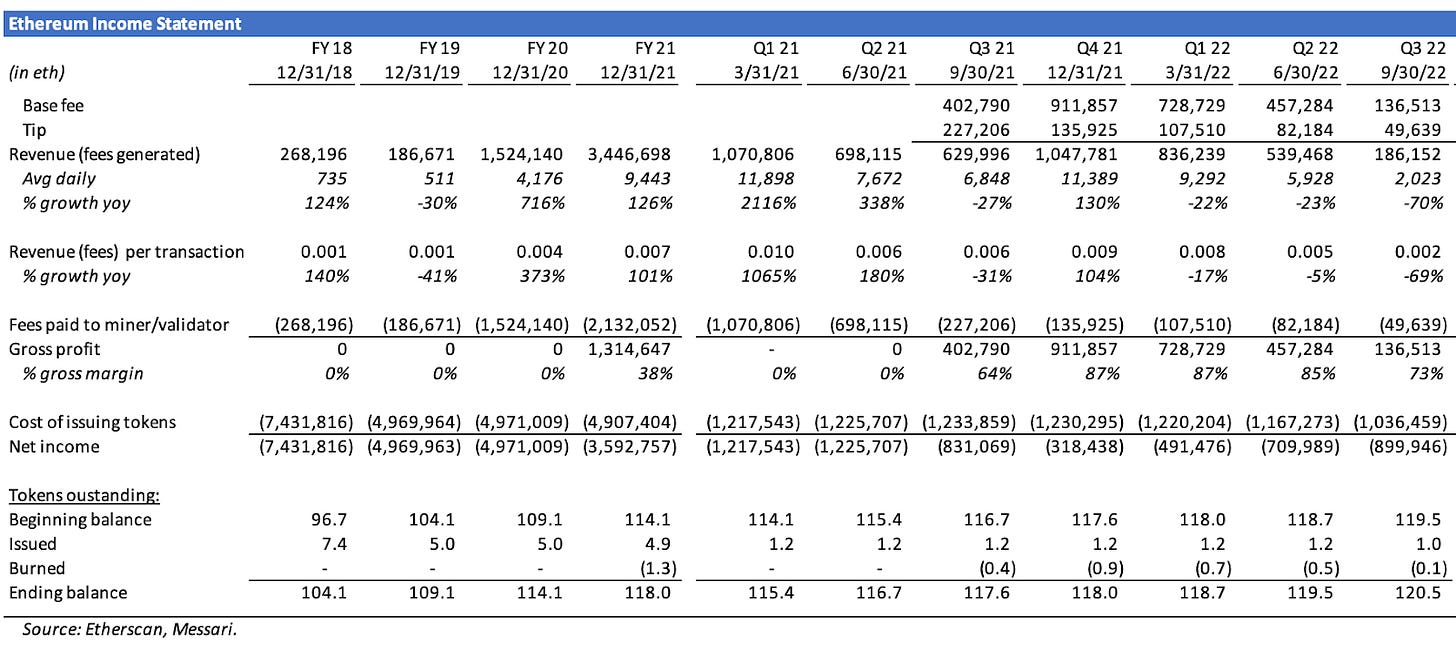

Commentary on income statement

Revenue: declined 70% yoy nearly entirely driven by revenue/transaction declining 69% yoy. It means it costs less to post a transaction to Ethereum. Fee declines are arguably a good thing. They can stimulate demand. However, notwithstanding a 69% drop in fees, the number of average daily transactions declined 4% yoy (per operating metric table).

Gross profit: increased dramatically in Q3’21 when EIP-1559 was introduced. EIP-1559 implemented Base fee and Tip. Only the tip is paid to miners. The base fee is earned by Ethereum and burned.

Cost of issuing tokens: has been stagnate. It was historically dependent on a set number of eth tokens paid to miners for contributing blocks. Since 2019, miners were paid 2 Eth tokens per block. New block issuance was the reason Ethereum was not profitable. The merge changed that. In PoS, validators are issued new blocks based on the amount of staked eth.

Merge pro-forma income statement

The income statement below shows the pro-forma impact of the merge. The income statement illustrates daily averages for the given period. Since the beginning of the year until September 14, roughly 13,000 new eth tokens were issued daily (see Cost of issuing tokens). The merge occurred on September 15. Thereafter, an average of 1,500 eth tokens were issued daily; a 90% decline.

As revenue increases, the number of eth tokens burned should eclipse the number issued to validators. Since the merge, the number of eth token issued to validators is just slightly above the number of tokens burned (highlighted in red box).

What does it all mean?

Ethereum is facing two opposing inflection points. Its operating metrics are deteriorating. Yet its profitability has dramatically improved subsequent to the merge.

There is hope that Layer 2 scaling solutions will drive demand for Ethereum blockspace. I believe it will. However, the hope has not yet materialized into improved operating metrics. The dramatic improvement in Ethereum cost base is only valuable if demand grows again.

Stay curious.

Follow me on Twitter @samuelmandrew for my latest.

Definitions

Operating metrics

Unique addresses: the total distinct numbers of addresses on the Ethereum blockchain.

Daily active eth addresses: the daily number of unique addresses that were active on the network as a sender or receiver.

Eth staked: the number of Eth tokens staked on the Beacon Chain.

Transaction volume USD: the sum USD value of all native units transferred.

Transaction volume ETH: the sum of Eth tokens transferred between distinct addresses.

TVL $: the USD sum value of all Eth tokens locked in DeFi.

TVL ETH: the sum of all Eth tokens locks in DeFi.

Income statement

Base fee: the portion of gas fee that is paid to Ethereum and burned. Introduced by EIP-1559. Implemented August 2021.

Tip: the portion of the gas fee that is paid to validators (previously miners). Introduced by EIP-1559. Implemented August 2021.

Fees paid to miners/validators: The fee paid to validators (previously miners) to process transactions. Prior to EIP-1559 implementation, all fees were paid to miners. Subsequent to EIP-1559, only the tip is paid to validators.

Gross profit: Total revenues less fees paid to miners/validators. Post EIP-1559, gross profit equals the base fee. The base fee is burned, which reduces the number of eth tokens outstanding.

Cost of issuing tokens: are the eth tokens issued to validators (previously miners). Prior to the merge, validators received 2 eth tokens for each block contributed. Subsequent to the merge, validators receive block rewards based on the total number of eth tokens staked.