Crypto DCF (Non)-Sense

How a DCF is (ir)-relevant for crypto

Can crypto assets be valued using a DCF?

A Discounted Cash Flow (“DCF”) is a hallmark of tradfi valuation. Commonly referred to earnings multiples and yields are shorthands for a DCF. Cash flows underpin valuations for productive assets.

In this article, I explain why DCFs don’t work in crypto. I posit that cash flow equivalent valuation models will emerge in crypto. I use Ethereum as a DCF case study. I explore the shortcomings of assumptions required for a DCF. Read on to discover what I think Eth could be worth.

This article is part of a series on crypto valuation. (See Does Value Exist in Crypto?)

DCF doesn’t work in crypto

Crypto assets are lacking a critical element for a DCF to work - cash flow. Cash flow, or some equivalent token version of it, is necessary to determine the value of a productive asset.

There are two problems that plague most protocols:

They’re loss making

The value created does not accrue to token holders

Nearly all protocols are loss making. A business is loss making if it spends more money than it earns. Its costs > revenue. A loss making business may still be valuable. But eventually, revenues > costs. A protocol is loss making when it issues more tokens than it generates in revenue. Its token issuance > revenue. Eventually, revenue > token issuance for the protocol to create economic value.

A protocol needs to have a means of distributing the profit to its token holders. Most protocols cannot. Tokens provide “governance” or “utility” rights to token holders. They usually do not provide a share of profit. If they did, they could be construed as securities by the SEC and regulated as such.

Cash flow-based valuation will emerge

Protocols are like businesses. They sell a product to generate revenue and incur costs in doing so. Profit is left over from deducting the costs from the revenues. For example, blockchains sell blockspace to users. Blockchains incur costs to secure the network and process inputs. It’s no different than a business other than the exchange is done in a native token instead of fiat. Replace USD with Eth or Sol and the mechanics are nearly identical.

Revenues will outpace costs for successful protocols. The alternative is the collapse of the network. The largest cost for protocols are token issuances. If the protocol continuously issues tokens at a faster rate than it grows revenue, it destroys value.

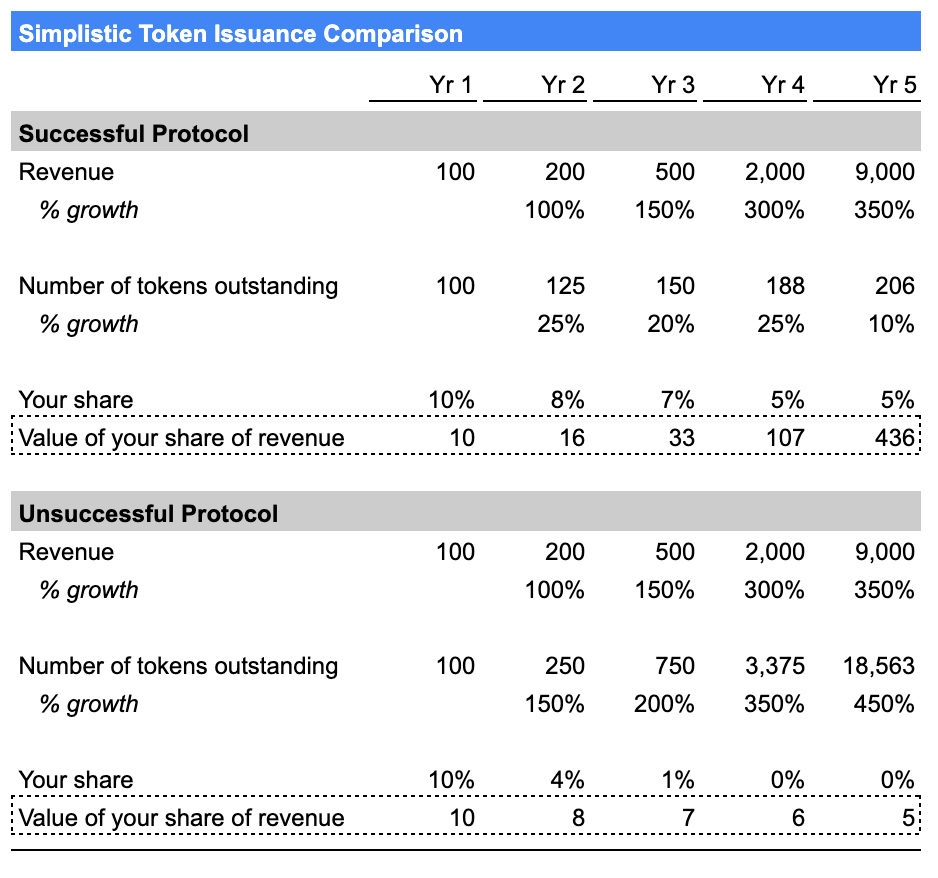

The table below simplistically illustrates this phenomenon. The Successful and Unsuccessful protocol’s only cost is token issuance. Both grow revenue at the same rate. The Unsuccessful protocol issues tokens at a faster rate than it grows revenue. Your initial ownership share of 10% gets diluted to nearly 0%. The value of your share is worth 50% less than when you started. Your share in the Successful protocol is diluted from 10% to 5%. Its value has increased 43x.

Economic value creation is critical for a protocol. If there is no economic value to owning the protocol’s token, then there is no incentive for validators to secure the network. The network will collapse. The token will be worthless.

I am confident that successful protocols will create economic value for their token holders. It’s the only way for them to thrive.

Economic value is created once revenue > costs. The excess, or profit, accrues to token holders by “burning” tokens. Burn is crypto speak for reducing the number of tokens outstanding. It’s the equivalent of a share buy-back in tradfi. All else being equal, the lower the number of tokens outstanding, the greater the value of the individual token.

Cash flow-esque valuations will emerge. Protocols will have to create economic value in the form of profits to ensure the security of the network. The value of the profits created will accrue to token holders. It’ll be no different than a business.

Ethereum is profitable subsequent to the Merge. Via EIP-1559 it has a mechanism to distribute value to its token holders. It’s the only blockchain that has both characteristics. It can be valued using a DCF.

Ethereum’s DCF

A DCF primer

A productive asset's value is derived from the cash flows that accrue to its owners. Cash is king.

A DCF analysis forecasts revenues and costs to determine cash flow to its owners. The total value of those cash flows is the value of the business at some point in the future. The future value is discounted back to the present. Discounting a future value is based on the premise that $1 today is worth more than $1 tomorrow, or certainly $1 in 20 years. $1 today can be invested for a return and will likely be worth more than $1 in 20 years. Working that same logic backwards, $1 in 20 years is worth less than $1 today.

A DCF is highly sensitive to two assumptions: growth and discount rates.

Ethereum’s “cash-flow”

Ethereum generates revenue from users buying blockspace. Users pay a transaction fee, known as a gas fee, for each transaction posted.

Gas fee per transaction x Number of transactions = Revenue

Ethereum has two costs. A variable costs to process transactions. A fixed cost to secure the network.

The part of the fee users pay to validators to process a transaction is called “tips.” It’s labeled “Fees paid to validators'' in the model. It’s a variable cost. A tip is incurred with each transaction. The amount of tip per transaction varies. In tradfi terms the tip is the Cost of Goods Sold.

Revenue - Fee paid to validator = Gross profit

Ethereum’s gross profit indicates the amount of Eth that is burned. Ethereum’s gross margin (gross profit/revenue) measures how profitable Ethereum is per transaction. Ethereum’s gross margin is ~80%. It also indicates the percentage of total Ethereum revenue that will be burned.

Ethereum’s fixed cost is its new token issuance. Tokens are issued to validators to secure the network. Token issuance is a “fixed cost” in tradfi terms. It does not vary with Ethereum revenue. Token issuance cost is driven by the amount of Eth staked by validators.

Gross profit - Token issuance = Net income

Ethereum’s net income is equivalent to its cash flow to owners in tradfi speak.

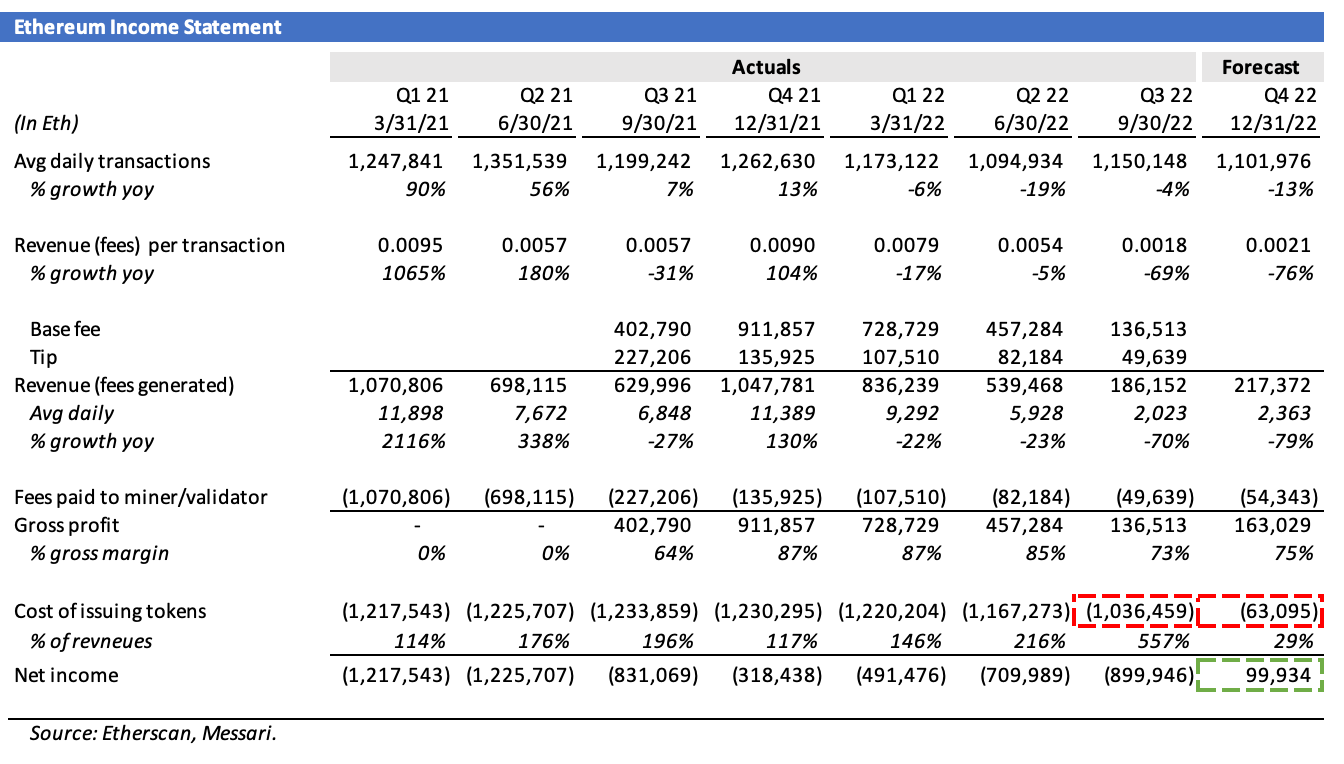

Ethereum’s profitability

Ethereum will be profitable in Q4’2022. The Merge was successfully executed on September 15. It switched Ethereum’s consensus mechanism from PoW to PoS. PoS reduced Ethereum’s new token issuance by over 90%. Token issuance in PoW was driven by a set number of Eth tokens issued per block. In PoS, new token issuance is driven by the amount of Eth staked by validators. New token issuance was by far Ethereum’s largest cost. It ranged from 114% to 557% of Ethereum revenues in 2021-22. Between 2018-19 it was nearly 3,000% of revenues.

The table below illustrates Ethereum’s quarterly Income Statement. Highlighted in red is the reduction of new token issuance. The Q4’22 profit is highlighted in green.

Ethereum’s gross profit went from 0% to ~80% when EIP-1559 was introduced in August 2021. Previously, all Ethereum revenue was passed through to miners/validators. Subsequent to EIP-1559, only the “tip” portion of revenues is paid to validators. The remainder is kept by Ethereum and burned.

Ethereum profits could 🚀

Ethereum could become incredibly profitable. It has 80% gross margins. Its fixed costs (i.e. new token issuance) will not grow with transaction volume. Revenues could return to prior +100% growth while its fixed cost base likely won’t grow more than 5-35% per year. I do not think there will be an explosion of Ethereum validators. The relative staking returns compared to tradfi assets is not attractive enough.

In tradfi terms, Ethereum’s cost base is highly scalable. It stands to benefit from operating leverage.

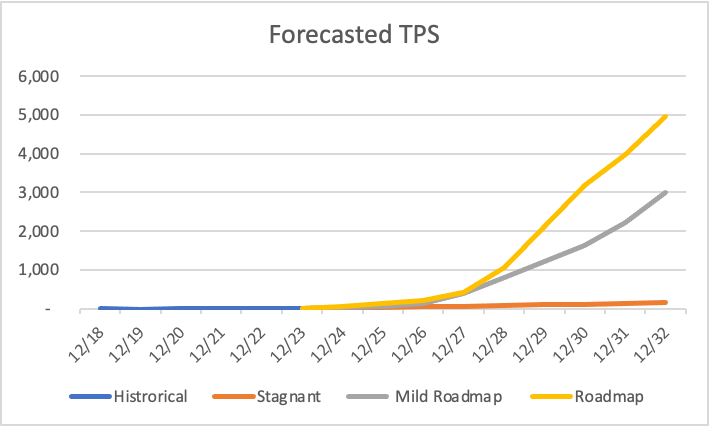

Ethereum’s forecasts

Forecasting Ethereum transaction volume is challenging. Transaction volumes should increase dramatically. Ethereum’s roadmap (read Ethereum can’t scale…or can it?) calls for transactions per second (“TPS”) to increase from 10 to 100,000 over an undisclosed time period. The increase will come from scaling the execution layer (a.k.a. Layer 1) and rollups (which happen on Layer 2). The TPS modeled are for the execution layer. Danksharding scales Ethereum’s execution layer. Danksharding should increase Layer 1’s TPS by at least 100x in the next few years. The “Mild Roadmap” and “Roadmap” case assume that happens and thereafter TPS continues to accelerate. It assumes that there is demand for the additional transaction volume supply.

Layer 2 rollups also scale Ethereum. They are not incorporated in this model. The transaction numbers in this model include transactions settled directly on Ethereum’s execution layer and transactions rollup-ed on Layer 2 and inputted as one transaction on Layer 1.

The “Stagnant” case assumes Ethereum doesn’t scale as planned.

There is a wide distribution of potential TPS forecasts.

Forecasting transaction fees is equally challenging. Transaction fees for the end user should decline to fractions of a cent. The bulk of transaction fee declines will come from Layer 2 rollups. Declining rollup fees do not impact transaction costs at Ethereum’s Layer 1, which is what this model forecasts. Danksharding should reduce transaction fees at Layer 1. By how much? I have no idea. Fees per transaction is a massive assumption I have little insight on.

Modeling the balance between volumes and price is nearly impossible. One theory posits that Ethereum’s Layer 1 transaction volumes will remain low and its fees exorbitantly high to secure the network. Instead, the transaction volume growth and declining fees will occur on Layer 2 and additional scaling solutions. Another theory suggests that scaling and low fees will be spread across Layer 1 and 2 and additional layers. It’s unclear how this dynamic will play out.

The result is a wide distribution of revenue outcomes and little confidence in the forecast.

The full forecast is visible in the table below and model available here. Gross margins are kept at 75-80%. New token issuance is modeled by assuming the amount of Eth staked. The model keeps the number of Eth tokens outstanding constant at today’s 121 million figure. The prevent value of total forecasted income is then converted at today’s Eth price of $1,500 and divided by 121 million tokens outstanding to infer an Eth price.

Ethereum’s discount rate

Ethereum forecasted net income (i.e. cash) needs to be discounted to the present. Determining the discount rate is about as challenging as forecasting Ethereum’s revenue.

Discount rate = Risk free return + βeta * (Expected return - Risk free return)

In English, the formula asserts that a discount rate is the sum of a risk free rate of return plus the βeta adjusted risk premium. The risk premium is the expected return less the risk free return. It captures how much additional return is warranted over a “riskless” return. βeta measures how much the asset’s price moves relative to its comparable market.

There are two schools of thought to calculate the appropriate discount rate: the tradfi method and DeFi method.

Tradfi method

US 10 year treasury yield of 4.1% is used for the risk free return. It represents the return of investing in a “riskless” asset. The S&P 500 average return of 9% is used as the expected return.

The βeta is hard to infer. βeta is calculated as the correlation between the asset and its comparable market. Back to high school math; βeta is the slope of the line of best fit in a scatter plot. In the case of Apple, for example, βeta calculates how much Apple stock moves for a given move in the S&P 500. The thing is, Ethereum is not correlated to the S&P 500. Over short periods, it is correlated, but over longer periods it is not. The scatter plot below regresses the daily price move in S&P 500 and Eth since January 2016.

Calculating βeta like this doesn’t make sense. There is no correlation. This approach cannot be used to calculate a discount rate.

DeFi method

USDC stablecoin yield of 1% can be used as the “risk-free” rate. Historical crypto market returns are used as the barometer for “expected return.” Crypto returns are highly dependent on what period is selected. For example, from January 2016 to present crypto markets generated 107% annualized return. From January 2018 to present the annualized return is 8%.

Is the expected return 107% or 8%?

It makes a massive difference on the discount rate. Since the expected return can’t be determined from historical returns, this methodology does not work.

Rule of thumb method

I use a best guest for a discount rate. Illiquid higher risk venture funds try to return 20-30% annualized returns. Ethereum needs to do at least that. The equity discount rate for most US stocks today is in the low teens. Crypto should be significantly higher than that given it’s a much risker asset. A mid-20% discount rate seems right.

Terminal value

DCF value is the sum of the present value of the forecasts and the terminal value. A terminal value is used instead of forecasting 100 years. The terminal value capitalizes the final year's forecast. The model assumes a 10-30x earnings multiple. It implies a 14-21% terminal growth rate, which means net income will grow 14-21% into perpetuity.

The terminal value represents 54-86% of the total value of Ethereum. These assumptions are critical.

DCF sensitivity

The output of the forecasts, discount rate and terminal value is an Eth valuation range of $293 - $10,633. You could park an aircraft carrier through that wide range. The range is so wide because the assumptions are so hard to refine.

If Ethereum shits the bed. The roadmap doesn’t pan out. Blockchain competition sets in. Eth is -80%. I like to think I’ll see the demise coming in Ethereum usage metrics. I’ll cut my position before eating the 80% decline. I could easily lose 50%.

If Ethereum nails the roadmap it’s worth at least $10k. If it hits a dialed back version of the roadmap or demand is muddled it’s worth $4k.

I’m willing to risk losing 50% to make 600%.

A few more thoughts

In theory, a DCF for Ethereum works. Ethereum has attributes of productive assets. It generates a profit and has a mechanism to distribute profits to owners. Eventually, other blockchains will as well.

In practice, a DCF for Ethereum doesn’t really work. The target prices are insanely sensitive to a change in growth assumptions and the discount rate. There is a saying “garbage in, garbage out.” A DCF is only as valuable as the quality of its assumptions. Ethereum assumptions are awfully hard to come by.

Assessing how to value crypto is increasingly important (read Does Value Exist in Crypto?). I’ll be discussing other methodologies in upcoming articles. My goal is to stimulate a much needed discussion on crypto valuation.

I welcome your feedback including where my analysis falls short.